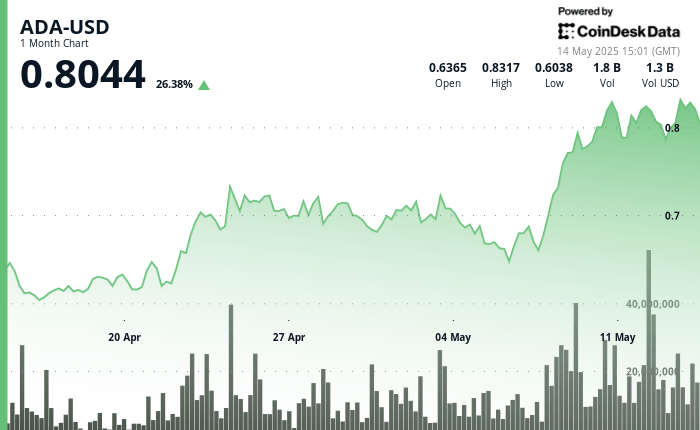

Global economic uncertainties are creating domain effects on cryptocurrency markets, with Cardano (ADA) that demonstrate remarkable volatility amid the feeling of changing investors.

After gathering 22% weekly, ADA has established a negotiation range between $ 0.795 and $ 0.841, which reflects the profits and strategic accumulation by larger investors.

Recent developments have strengthened the position of the Cardano market, particularly their addition to the digital digital background and integration with the Brave Browser wallet system. These associations have significantly expanded the Base of Potential Users from ADA, with the brave integration only connecting more than 86 million users worldwide.

Market data shows that institutional participation has intensified, and chain analytics reveal that holders that control between 100 million and one billion accumulate more than 40 million tokens in just two days. This whale activity coincides with Ada’s rupture from a descending channel pattern, which suggests potential for a more upward movement despite short -term volatility.

TECHNICAL ANALYSIS

- Ada exhibited significant volatility during the 24 -hour period, establishing a range of 0.047 (5.9%) between the minimum of 0.795 and the maximum of 0.841.

- The price action formed a clear bullish trend during the first half of the period, with a high volume purchase at the 0.805 support level that drives Ada to its peak.

- A subsequent correction phase arose as an intensified gains taking, with a notable sales pressure around the resistance level of 0.828, particularly during the 08:00 hours when the volume increased to 90 million units.

- The lowest high ups and downs, since the peak suggests that the impulse may be decreasing, although the price continues to find support above the level of 0.810, which indicates a possible consolidation before the following directional movement.

- In the last hour, the adap experienced significant volatility with an acute rally followed by proper correction.

- The price action showed a strong impulse from 13:06 to 13:33, rising from 0.816 to a peak of 0.827, which represents a gain of 1.3%.

- However, the sales pressure intensified dramatically around 13:44, which caused a strong decrease of 1.5% to 0.809 in a matter of minutes.

- The formation of a double fund in the support zone 0.809-0.810 caused a moderate recovery, with the stabilizer price in the 0.813-0.816 range by the end of the session.

- The volume analysis reveals a particularly heavy trade during the correction phase, with more than 2.7 million units exchanged during candle 13:44, which suggests an institutional gain taking after the previous bullish trend.

Discharge of responsibility: This article was generated with artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with our standards. For more information, see Coindesk’s complete policy. This article may include information from external sources, which are listed below when appropriate.

External references