The $40,000 put option has become one of the most important positions in the bitcoin market ahead of its expiration on February 27, highlighting the strong demand for downside protection after a forceful sell-off.

Options are derivatives that give their holders the right, but not the obligation, to buy or sell bitcoins at a predetermined price before expiration. Put options act as insurance against price declines and pay out if BTC falls below a set strike.

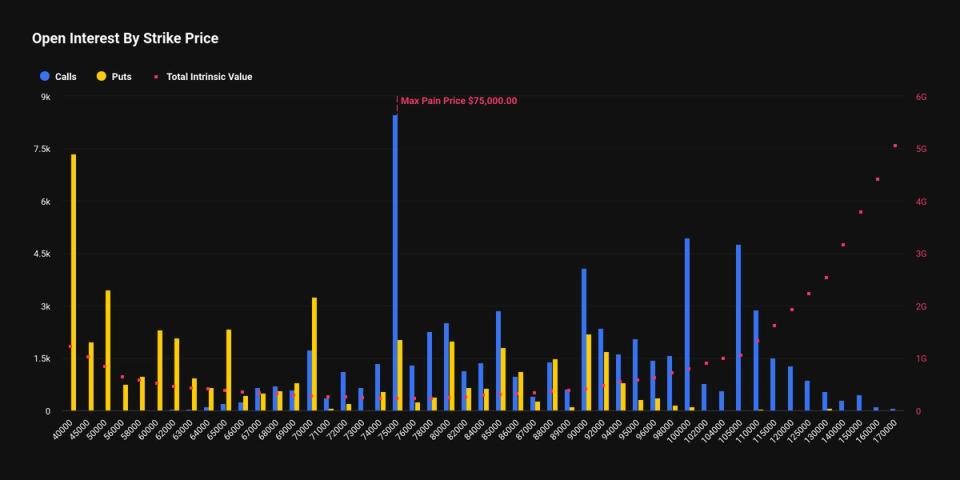

The $40,000 put option is the second-biggest open interest gain, with roughly $490 million in notional value tied to that level, underscoring the appetite for deep tail risk hedges. BTC has fallen as much as 50% from its October highs and is now trading around $66,000, reshaping positioning across the board as traders hedge against further losses.

Data from Deribit, the Dubai-based exchange owned by Coinbase, shows that approximately $7.3 billion in face value of bitcoin options will expire at the end of the month.

Meanwhile, $566 million is in the $75,000 strike, which also represents the maximum level of pain. Maximum pain refers to the price at which the greatest number of options expire worthless, minimizing payouts to buyers. With the spot price trading below $75,000, a move higher to expiration could reduce losses for call sellers.

Although calls outperform puts overall, with 63,547 calls contracts versus 45,914 puts, the positioning is not purely bullish. The put-call ratio of 0.72 indicates that upside bets still dominate, but the concentration of significant open interest in puts at lower strikes highlights clear insurance demand on the downside.

Traders maintain exposure to a rebound, but at the same time protect themselves against the risk of another sharp decline.