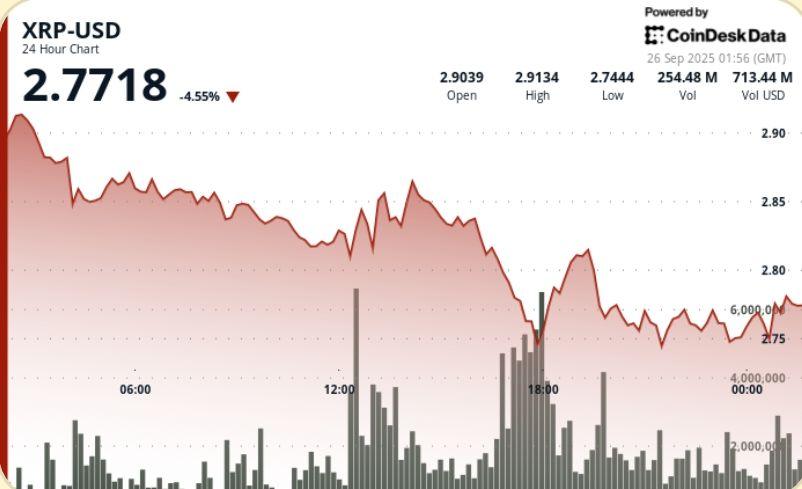

The XRP impulse above $ 2.90 collapsed under a heavy sale on September 25, with a volume timbre price of $ 277 million back to $ 2.75.

The measure deleted more than $ 18 billion in market value during the past week and confirmed a new resistance to $ 2.80, leaving merchants prepare for a $ 2.70 support test.

News history

• XRP slipped 5.83% during the session from September 25 to 26, falling from $ 2.92 to $ 2.75 in a large institutional sale.

• A strong rejection of $ 2.80 during 5:00 p.m. activated an increase in volume of 276.77 million volume, more than 2.5 times the average of 24 hours.

• Despite the approval of the SEC of the First ETF XRP of the USA., Optimism has been compensated by Powell’s warnings about valuations and the increase in treasure yields.

• During the last week, the XRP market value has hired at $ 18.94 billion, 10.22%less that broke below the $ 3.00 psychological threshold.

Summary of the price action

XRP quoted between $ 2.92 and $ 2.74, an intradic range of 6.3%, before closing about $ 2.75.

• Sellers dominated after the rejection of $ 2.80 in the extreme volume, creating a distribution zone that limited more upwards.

• Subsequent recovery attempts were arrested in around $ 2.81– $ 2.82, confirming new resistance groups.

• The final time saw a brief bounce of 1.09% of $ 2.75 to $ 2.78, driven by concentrated flows between 00: 50–00: 57 in volumes greater than 3 million per sail.

• Short -term support is now seen at $ 2.75– $ 2.77, with a low risk of $ 2.70 if it is infringed.

Technical analysis

• Range: $ 0.18 (6.3%) between $ 2.92 high and $ 2.74 minimum.

• Resistance: Initial rejection of $ 2.80; $ 2.81– $ 2.82 groups formed in failed reestimations.

• Support: $ 2.75 area defended in the late session; $ 2.70 Psychological level Next Watch.

• Volume: 276.77Ma at 5:00 p.m. 108.42M daily average.

• Pattern: Distribution of high volume rejection signals. The short -term consolidation about $ 2.77 suggests indecision before the next movement.

What merchants are seeing

• If $ 2.75 is maintained through the Asia session or breaks around $ 2.70.

• ETF optimism versus real money outputs: the news sales pattern remains at stake.

• The whale flows after $ 800 million in transfers during last week; Risk of positioning if it is sold by resuming.

• Macro Overhang: Powell’s aggressive tone, the treasure throws climbing, Fed cut the limited expectations.