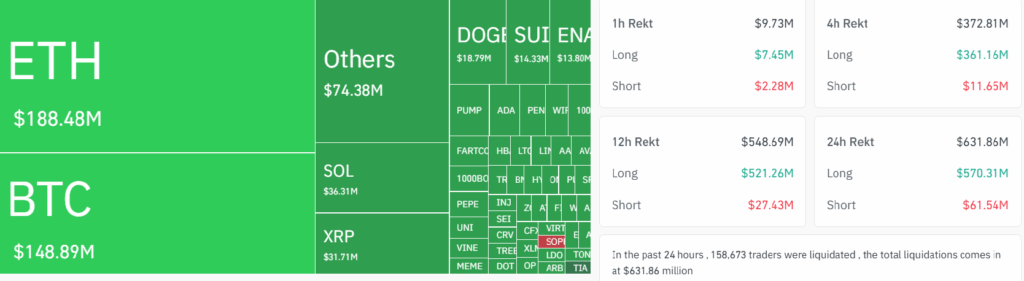

Crypto Markets experienced a strong episode of volatility in the last 24 hours, with more than $ 630 million in leverage positions liquidated in exchanges.

Most of the damage caused by Longs, which represented more than $ 580 million of total liquidations, since the merchants were trapped offside during an abrupt sale of intraiments.

Bitcoin (BTC) fell to $ 115,200, erasing some of its recent profits, but even maintaining a relatively stable position compared to other specialties. His domain increased slightly when Altcoins endured the worst part of the correction.

Ether (ETH) fell to $ 3,687, while XRP (XRP) turned over $ 3 despite the strong recent headlines. Solana (Sol) retired to $ 170, and BNB (BNB) decreased to $ 780 after a record race last week that exceeded it above $ 855.

Caramel data shows that the largest liquidation was $ 13.7 million eth long in Binance.

The liquidations occur when merchants who use leverage (funds provided) are closed by force outside their positions because their guarantee falls below the required maintenance thresholds. This generally amplifies prices volatility, especially in short deadlines, since liquidated positions create a sudden sales or purchase pressure depending on the side of the trade.

For merchants, the liquidation data provides information about the feeling of the market and the risk of positioning. Total liquidation highs, particularly concentrated in one direction (for example, lengths), often indicate overextended positioning. This may indicate possible inflection points or imminent reversals as the market is restored.

The monitoring of heat maps and real -time liquidation financing rates can help merchants identify areas of forced sales or purchase, often around the key levels of support/resistance, time tickets or exits during areas of high volatility and leverage of the meter market and risk behavior/deactivated

The speculative alternatives were particularly affected. The Tokens Solana-Ecosystem, such as Fartcoin (FART), Pump.fun (bomb) and Jupiter (JUP), all steep intradic corrections.

“We observe that tokens such as Fartcoin and Pump.Fun are less aligned with the largest market in the market and reflect more high volatility and feelings -based microcycles,” said Ryan Lee, Chief of Bitget, in a telegram message.

“Recent corrections, a fart that falls by 14% to test their 100 -day EMA about $ 1, JUP losing support in its 200 days and pumping that continues its slide within a descending channel, seem derived from the profits and decrease the short -term impulse, not a systemic market change.”

Lee added that Bitcoin’s relative force, backed by ETF entries and macroeconomic stability, reinforces the opinion that the recoil is isolated, not broad base.

Bitcoin that remains above $ 115,000 remains the anchor of the market. Unless that level is broken, the widest structure remains intact.