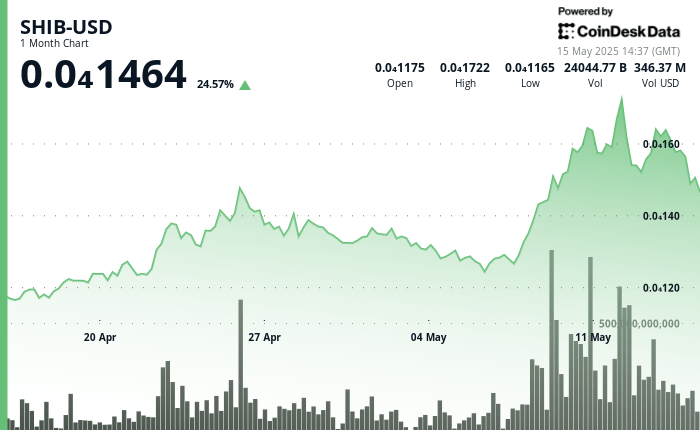

The cryptocurrency market feels the effects of changing global economic conditions as Shiba Inu (Shib) faces significant downward pressure.

Meme’s recent price action shows a clear lower trend with consecutive lower maximums, breaking multiple support levels.

The most intense sale occurred during the 07:00 hours when the price collapsed to 0.0000149, and the volume almost doubled the average negotiation rate.

TECHNICAL ANALYSIS

- Shib fell from 0.0000159 to 0.0000149, representing a 6.4% decrease with a general range of 0.0000012 (7.5%).

- The price action formed a clear downward trend with the highest consecutive maximums, breaking multiple support levels around 0.0000156 and 0.0000152.

- The high volume sale occurred during the 07:00 hours when the price collapsed to 0.0000149, with a volume greater than 1.43 billion Shib, double the average negotiation volume.

- The resistance formation at 0.0000152 and support to 0.0000148 suggests a possible consolidation before the following directional movement.

- In the last hour, SHHHHICs experienced significant volatility with a strong decrease of 0.0000151 to 0.0000147, followed by a modest recovery to 0.0000149.

- The most intense sales pressure occurred between 13: 33-13: 36, with a volume of more than 83 billion Shib at 13:35, establishing a critical support zone around 0.0000148.

- The price of the action formed a V -shaped recovery pattern after reaching the minimum of the session of 0.0000147 at 13:51, with an increase in the purchase of impulse that pushed Sib above the level 0.0000148.

Discharge of responsibility: This article was generated with AI tools and reviewed by our editorial team to guarantee the precision and compliance with our standards. For more information, see Coindesk’s complete policy. This article may include information from external sources, which are listed below when appropriate.

External references