The Native Chainlink card Stagnant on Wednesday after a strong start of the week, returning some of the news profits on the presentation of the asset managers scale to convert its closed bottom into a negotiated background into a stock market (ETF).

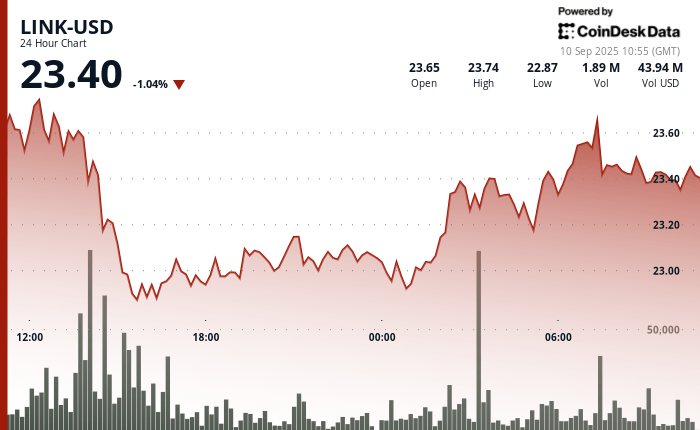

The Token has dropped approximately 1% in the last 24 hours in a volatile session, experiencing a pricing swing of 7%, according to the technical analysis model of Coindesk Research.

The price action followed the real estate and the Arizona Caliber assets manager (CWD) Tuesday announcement that completed its first purchase of link tokens, marking the start of its digital assets treasury strategy.

Their shares fired almost 2,000% on Tuesday before returning a majority of the profits, lowering another 20% on Wednesday before the market. The company did not reveal the amount of tokens bought.

The measure makes the caliber the first company that is quoted in Nasdaq to adopt a treasure reserve policy focused on the link. The company said it aims to accumulate the link over time using existing lines of credit, cash reserves and actions based on shares, with plans to bet tokens to generate performance.

Technical analysis

- Negotiation performance: Link registered a modest 1% decrease during the 24 -hour period, experiencing volatile intradic changes of 7% between $ 22.84 and $ 24.46, showed the technical analysis model of Coindesk Research.

- Volume indicators: Commercial activity increased to 3.78 million units at 14:00 on September 9: 00 UTC, exceeding the average of 24 hours and establishing support near the price level of $ 23.

- Resistance tests: The maximum intra -ease of $ 23.49 found a sales pressure before decreasing through minor support levels, indicating a profit taking activity and a possible preparation for the additional discovery of prices.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.