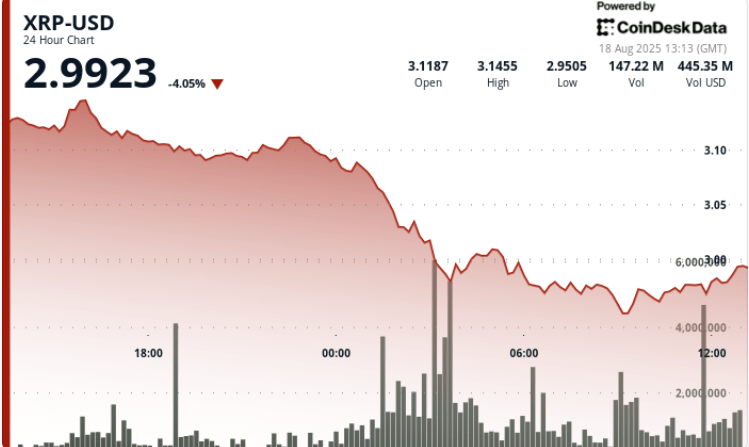

XRP slipped to $ 2.97 at its stronger decrease in weeks, throwing 5.4% in a 23 -hour stretch as a retail sale that sells overwhelmed books.

The movement occurred in volumes that eclipsed the daily averages, but the whales whales silently absorbed the fall, obtaining 440 million tokens worth $ 3.8 billion. The divergence between retail capitulation and institutional accumulation establishes a fundamental point around the $ 3.00 brand.

News history

• XRP fell from $ 3.14 to $ 2.97 in less than 24 hours, publishing its most steep setback since July.

• Whale buyers added 440 million XRP even when retail merchants showed holdings.

• A symmetrical triangle pattern has been formed, with a rupture objective about $ 3.90 if the resistance is erased.

• The broader cryptographic markets saw a correlated weakness in the middle of the increase in risk.

Summary of the price action

• XRP lost 5.41% in the 23 -hour window ended on August 18 at 08:00.

• The heaviest sale came between 01: 00–03: 00, with a collapse of $ 3.08 to $ 2.97 in a volume of 172 million.

• The final time saw an attempt to recolored recovery, raising XRP of $ 2.97 to $ 2.98.

• The trade stopped in the last four minutes of the session, which suggests the closure or interruption of the data.

Technical analysis

• The resistance is grouped to $ 3.08– $ 3.14, the area that limited the recovery attempts.

• The support has changed to $ 2.96– $ 2.97, where whales absorbed the supply.

• A symmetric triangle points to an upward target of $ 3.90 if $ 3.26 is broken.

• Golden Cross emerged last week, but the signal has not yet triggered tracking.

• Volatility remains elevated, with an intradic range of $ 0.18 and a 163% increase in volume versus averages.

What merchants are seeing

• If the whales continue to absorb the sauces about $ 3.00 of support.

• Breakout or rejection of $ 3.08– $ 3.14 Resistance zone.

• Impact of trade arrested in the final minutes: market failures or structural weakness.

• Continuation of a broader sale or stabilization of the market.

• Confirmation of the triangle rupture to $ 3.90 or a breakdown below $ 2.96.