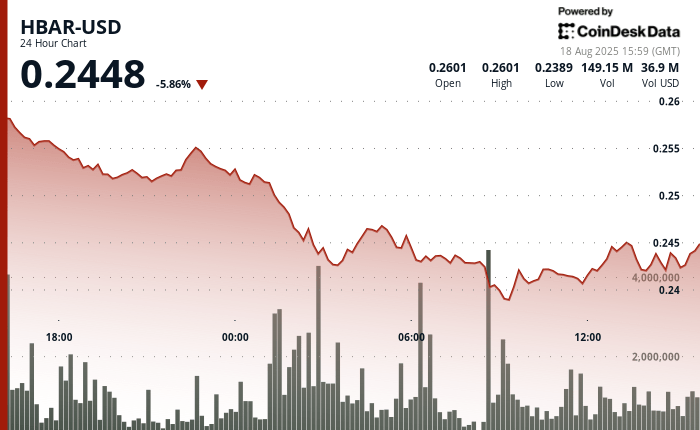

Hbar faced strong downward pressure in the last 24 hours, falling 6.68% of $ 0.26 to $ 0.24, while commercial activity increased more than 109 million tokens, double the daily average. The most steep fall occurred during the night sessions, when sellers accelerated the outputs and forced prices at a much more acute rate than normal. Analysts attribute volatility to the largest market stress triggered at $ 460 million in liquidations, aggravated by US economic data. UU. Shows that the producer’s price index increases to 3.3%.

Despite short -term weakness, market strategists maintain a long -term bullish perspective for the native token of Hedera. The objectives remain established between $ 0.40 and $ 0.50, although merchants are being warned of potential turbulence in the interim. With the indicators of feelings that point to overheated conditions, technical observers warn that acute changes remain probable since the market digests both winds against winds against and sudden liquidity shocks.

Meanwhile, Binance has moved to integrate HBAR into its BNB smart chain infrastructure, a step designed to improve the interoperability of the cross chain. Development will allow softest asset transfers and expand access to intelligent contracts in blockchain ecosystems, reinforcing the usefulness of hedera. Even so, integration comes as Hbar is consolidated under resistance, underlining the challenge of balanceing long -term adoption narratives with short -term market pressures.

Technical metric

- Hbar registered an added negotiation range of $ 0.018, which constitutes 6.93% of the maximum valuation during the session.

- Robust resistance properly consolidated the threshold of $ 0.252 with multiple rejection attempts.

- Support infrastructure identified about $ 0.240, providing temporary price stabilization.

- Negotiation volumes exceeded 109 million tokens, significantly exceeding the 24 -hour average of 58.5 million.

- The 20 -minute terminal period exhibited a complete market paralysis at $ 0.243 in an insignificant volume, which suggests possible technical interruptions or conditions of acute illiquidity.

- The consolidation of different resistance arose around $ 0.245 during the final negotiation time.

- The provisional support materialized near the market level of $ 0.242 prior to market stagnation.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.