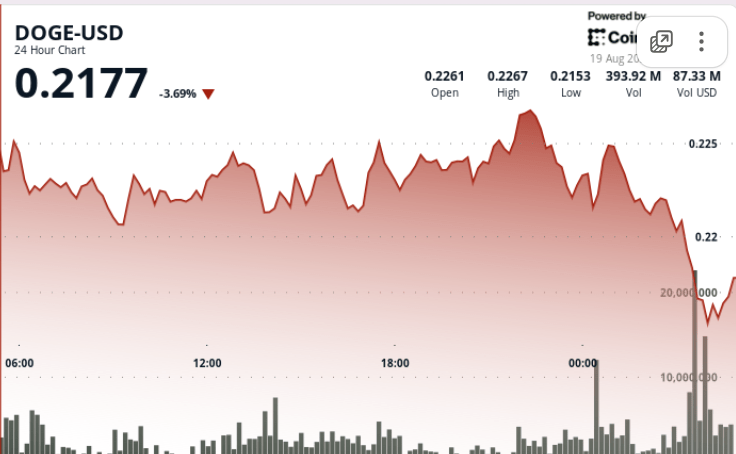

Dogecoin slipped overnight, erasing profits despite the strong institutional accumulation, since $ 782 million in negotiation volume overwhelmed the support levels and sent the token to the correction mode.

The movement occurred together with broad cryptographic liquidations, reflecting greater macro pressure.

News history

• Dogecoin fell from $ 0.23 to $ 0.22 in a 24 -hour window ending on August 19 at 04:00, marking a 4%decrease.

• An acute liquidation wave between 03: 00-04: 00, where the volumes shot 782 million Duxts, almost double the daily average.

• The decrease occurred when the liquidations of the entire industry exceeded $ 1 billion, caused by the inflation impressions of the United States that exceed the expectations and hopes of feeding rate rate.

• Despite the fall, institutional buyers have accumulated 2 billion duxtales for a value of approximately $ 500 million this week, raising total holdings to 27.6 billion.

Summary of the price action

• Doge quoted within a band of $ 0.01, reflecting 5% of intradic volatility.

• Crash during the night he drove the Token to test the support of $ 0.22, now seen as the key level to defend.

• An attempt to bounce the late session raised prices modestly towards $ 0.22, indicating the demand in the minimums.

• The resistance is being built about $ 0.23, where the profit sales and heavy sales orders reappear.

Technical analysis

• Disglossa of $ 0.23 Invulidados Previous bullish structure, with $ 0.22 emerging as a new short -term floor.

• The volume increase of 782 million dux validates the sale of capitulation, a possible precursor of the lower formation.

• Support: $ 0.22 (critic), followed by $ 0.21 if the pressure persists.

• Resistance: $ 0.23 (immediate), $ 0.25 (major rupture threshold).

• The indicators suggest mixed signals: RSI that is approaching the overene, but the impulse remains negative.

What merchants are seeing

• If the institutional accumulation continues whether $ 0.22 cracks: pointing out sentences or withdrawal of smart money.

• Strange market risk feeling: the weakness of equity and winds against macro are still the dominant driver.

• $ 1 billion+ in cryptographic settlements, fragility stand out; Another macro shock could be deepened.

• A $ 0.23 claim would be seen as a short -term investment trigger, otherwise, the $ 0.21 support test is likely.