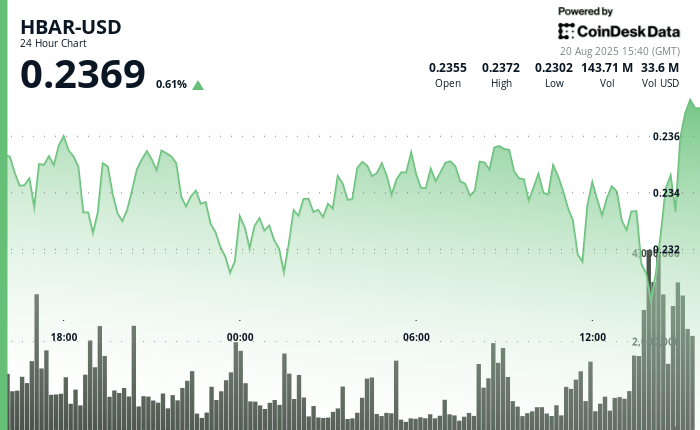

The Token Hbar of Hedera Hashgraph faced a strong sales pressure during a volatile a 23 -hour stretch between August 19 at 3:00 p.m. and August 20 at 2:00 p.m., sliding 3% of $ 0.24 to $ 0.23.

The Token quoted within a narrow band of $ 0.01, which marked an extension of 4% between its high and low session, since the merchants adjusted the exposure through alternative digital assets. The analysts highlighted the level of $ 0.24 as a key resistance point, where the purchase of impulse faded and intensified the pressure down.

The most pronounced activity occurred during the last hour of negotiation on August 20, when the volumes increased to 85.82 million hbar.

Market observers noticed that the Token fell to $ 0.23 before organizing a modest recovery at the closure, a pattern that underlined high volatility. The great rotation during this window suggests that sellers were dominant, creating short -term weakness and testing key support levels.

Between 13:45 and 14:06, more than 3.8 million tokens changed hands, coinciding with the most acute part of the decline. The prices briefly fell to the minimums of the session before bouncing, since the purchase of interest resurfaced to stabilize the market.

In the last minutes, Hbar recovered enough to close about $ 0.23, indicating that although the downward risks remain, short -term support is maintained for now.

Analysis of technical indicators

- The Token decreased 3% of the opening price of $ 0.24 at the closing price of $ 0.23 during the institutional sales period of 23 hours.

- The negotiation range of $ 0.01 represents 4% extension between the absolute and low session.

- The level of resistance established around $ 0.24 where the institutional purchase interest decreased significantly.

- The support level arose about $ 0.23 with retail purchases that provide technical floor.

- The high volume of 85.82 million during the final hours confirms the institutional distribution patterns.

- The volume exceeded 3.8 million during the maximum sales period between 13: 45-14: 06 which indicates coordinated liquidation.

- The last 14 minutes showed a technical recovery of the support level of $ 0.23, which suggests a retail purchase interest.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.