Oracle Network Chainlink (LINK) Token native showed a notable strength during Wednesday’s session, since cryptocurrencies tried to recover from yesterday’s butcher shop.

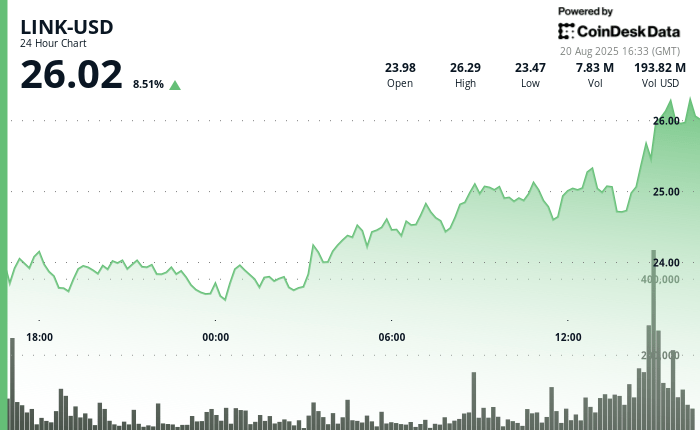

Link exceeded $ 26, won 8.3% in the last 24 hours and erased the losses of Tuesday. Greatly surpassed most of the crypts of great capitalization, including bitcoins (BTC) modest 0.5% and ether (Eth) 4% rebound during the same period.

The Crypto Market Coendesk 20 reference index increased 1.5%.

The relative force of the Token underlines the improvement of Chainlink’s attraction for cryptographic investors such as a key infrastructure that connects traditional markets with blockchain rails, which benefits from accelerating institutional adoption.

Sergey Nazarov, co -founder of Chainlink, said Tuesday that he met with the American senator Tim Scott, president of the Senate Banking Committee, leading the effort to carry the draft law of the market structure to the Senate.

“This new version of the market structure bill has many advantages over past versions, allowing our industry to grow rapidly in the US. UU. With fewer limitations,” Nazarov said in an X publication.

The Chainlink reserve, an initiative that channels the income of the integrations and protocol services to buy link tokens, reflecting the shares of public companies, also supports the price of the Token.

The installation has accumulated 109,664 tokens worth approximately $ 2.8 million in two weeks and is ready to run the next weekly purchase on Thursday, as shown in the data.

Technical analysis

Link showed an exceptional price impulse along the 24 -hour session, successfully breaking the critical resistance areas in the high negotiation volume before the transition to a consolidation phase, according to the technical analysis data of Coindesk’s Research.

- Price increase of 8.30% of $ 23.96 to $ 25.93 during the 24 -hour period.

- The strong support levels were formed around $ 23.50- $ 23.60 of zone.

- Broken key resistance at $ 24.50 and $ 25.20.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.