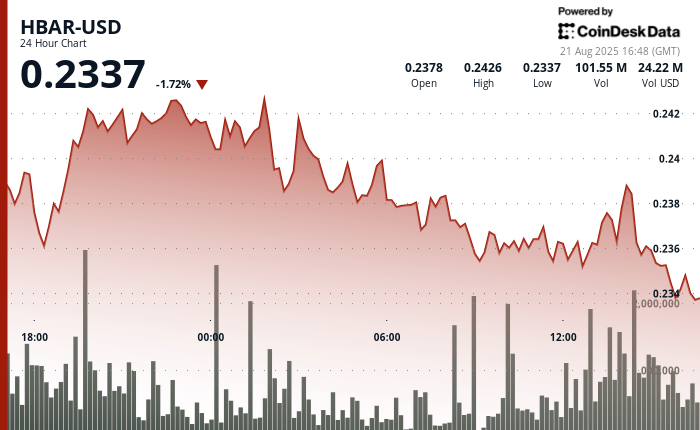

Hbar quoted in a range of 4% narrow but active from August 20 to 21, rising to $ 0.24 at night before correcting $ 0.23 early the next day. At the end of the session, the Token had recovered $ 0.24, reinforcing the $ 0.23– $ 0.24 band as a support and accumulation zone.

The rebound occurs when the broader macro conditions favor digital assets. The Federal Reserve has maintained rates below 2%, with increasingly more pricing markets in cuts that could provide a short -term impulse for cryptography.

Institutional developments are also strengthening feeling. Global Payments Network Swift launched the Blockchain Live tests with Hedera, while the Groyscale asset manager presented a Delaware Trust for Hbar, a movement seen by some as I feel work for a future ETF.

Together, these factors highlight the increase in institutional interest in business blockchain infrastructure. As the central banks and financial institutions accelerate the tests of the tokenized liquidation systems, the positioning of hedera within the global payments is gaining attention. The last recovery of Hbar can indicate more than intradic volatility: it reflects a growing confidence in the role of hedera in digital finances.

Technical indicators

- The price demonstrated an explosive volatility during the 60 -minute period of August 21 from 13:22 to 14:21, increasing from $ 0.24 to a pico of $ 0.24 that represents the progress of 1%.

- The last 15 minutes demonstrated an unprecedented bullish impulse as the price shot at $ 0.24 to close to $ 0.24 amid critical volume peaks.

- Session showed a classic support formation around $ 0.24 with multiple successful reestimations.

- The resistance to $ 0.24 was decisively tested in the closing phase, which suggests a strong institutional accumulation.

- Negotiation volumes exceeded 2.8 million during periods of rupture indicating a significant market interest.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.