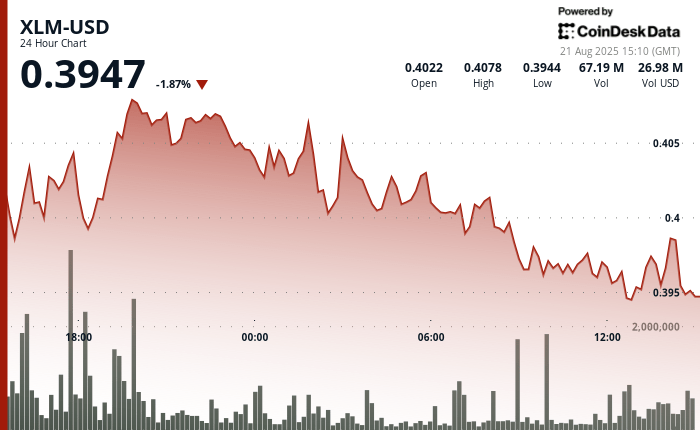

XLM negotiated in a narrow band between $ 0.39 and $ 0.41 in a 24 -hour stretch that ends on August 21, reflecting a consolidation phase before a possible movement. The vendors repeatedly crowned upwards at $ 0.41, while the buyers defended the support of $ 0.40, maintaining the volatility submitted. A gradual fall in volume suggested that merchants were positioning for an attempt to break.

That rupture came in the last hour of negotiation, when XLM recovered from $ 0.396 to $ 0.399. The strong purchase impulse pushed through the resistance level of $ 0.398, accompanied by an acute peak in a volume greater than 1.5 million tokens negotiated. The Push established the maximums intradic fresh, reinforcing a short -term bullish configuration.

The broader market currents also support the growing demand for payment centered. The changing commercial dynamics, the stablecoin marks in evolution and the greatest risks of inflation linked to the pressures of the supply chain are remodeling the panorama of global payments. In this context, XLM’s recent strength reflects a growing interest in blockchain -based settlement alternatives.

Technical indicators indicate a bullish impulse

- The price action broke the resistance level of $ 0.398 with a strong volume confirmation.

- The negotiation range of $ 0.01 or 3% indicates the volatility contained before the rupture.

- Spike volume greater than 1.55 million during the final time suggests institutional interest.

- The support established around $ 0.40 with multiple successful rebounds.

- The decrease in volume trend was reversed during rupture, indicating a renewed conviction.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.