Oracle Network Chainlink’s native token (Link) was abruptly recovered from the widest cryptography market after the dovish comments of the Federal President Jerome Powell in Jackson Hole, Wyoming.

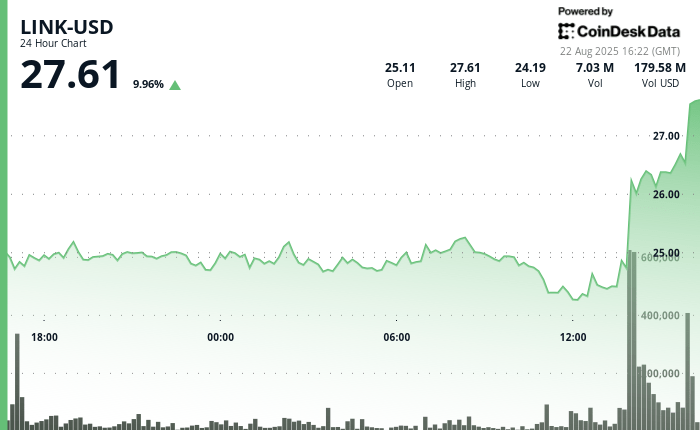

Link recovered 12% in the last 24 hours, reaching $ 27.8, its strongest price since December. Bitcoin (BTC) appreciated 3.5% during the same period, while the large market index of broad market increased by 6.5%.

In specific protocol news, Chainlink obtained two important security certifications this week: ISO 27001 and a SOC 2 type 1 certification, marking a first on a blockchain oracle platform. The audits, carried out by Deloitte, covered Chainlink’s price foods, reserve test services and the cross -collapsed interoperability protocol (CCIP).

Oracle’s provider says that the measure strengthens confidence in its data services and can reinforce adoption between banks, assets of assets and decentralized finance protocols.

In addition, supporting the rally, the chain reservation, which periodically buys link tokens in the open market using protocol income, bought 41,000 tokens on Thursday, with a value of approximately $ 1 million at that time. That led Total Holdings to 150,778 tokens, around $ 4.1 million at current prices.

Technical analysis

- Support levels: substantial defense established at $ 24.15 with high volume confirmation, according to the technical analysis data of Coindesk Research.

- Resistance penetration: systematic progress through $ 25.00, $ 25.50 and $ 26.00 with volume validation of institutional participants.

- Negotiation volume analysis: Exceptional volume increase of 12.84 million during the rupture phase, which represents the average of 24 hours of 2.44 million units five times.

- Consolidation patterns: Extended consolidation of narrow range around $ 24.70- $ 25.10 Previous Explosive Explosive Boosting Institutional.

- IMPULSE INDICATORS: SUSTAful Ascending Trajectory With early characteristics measures and signs of institutional accumulation of corporate treasure operations.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.