The meme token rises to $ 0.24 peak with an almost duplication of monthly averages, indicating the institutional activity behind the rally.

News history

• The Federal Reserve indicated a softer position on the rules of cryptographic banking, while Wyoming launched the first stablecoin backed by the State. Both developments raised the feeling around digital assets.

• The entity linked to Trump Thumzup completed an acquisition of $ 50 million from Dogecoin Degehash’s mining firm, forming what executives claim that it is the largest Dux Minera operation.

• Sofi became the first American banking institution to integrate the Bitcoin ray network for remittances, reinforcing the broader institutional adoption of cryptographic infrastructure.

• Whale wallets accumulated 680 million tokens dogated to August, cementing the growing institutional flows despite the volatility driven by retail trade.

Summary of the price action

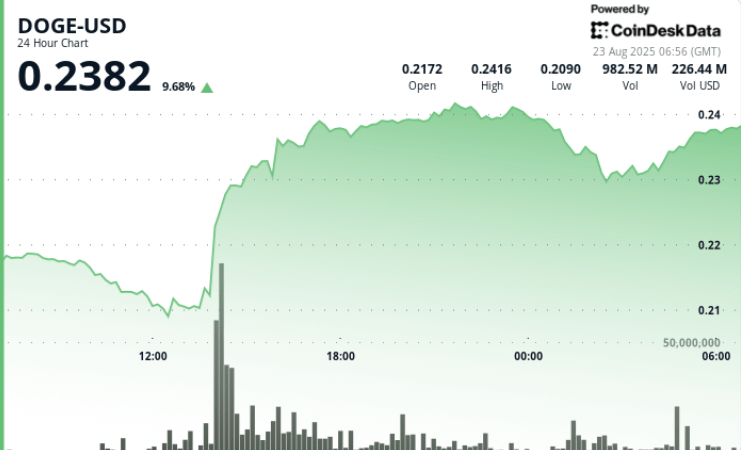

• Doge recovered 8% in the session from August 22 to 23, rising from $ 0.22 to $ 0.24 in a range of $ 0.02.

• The most acute movement occurred at 14:00 GMT on August 22, when Dege shot at $ 0.21 to $ 0.23 in a volume of 4.27b, almost use average per hour.

• Support is now maintained at $ 0.21 after a new successful test, while resistance limited profits at the psychological level of $ 0.24.

• An increase in the late session added 1% of $ 0.23 to $ 0.24, with a volume peak of 28.1ma at 04:52 GMT confirming the accumulation.

• The price action shows higher minimums, which suggests a sustained purchase pressure and a possible continuation of the trend.

Market analysis

Doge rupture aligns with a broader cryptographic rebound as the risk appetite improved in digital actions and assets. The combination of the recalibration of Fed policies, the adoption of establishment at the state level and a high -profile mining acquisition amplified institutional participation in a token often seen as purely driven by retail trade.

The level of $ 0.24 remains a critical turning point. A sustained rupture could open impulse objectives towards $ 0.26, while the risks of failure renewed the reestimations of a $ 0.21 support.

Technical indicators

• 24 -hour gain of 8% of $ 0.22 to $ 0.24 with a negotiation range of $ 0.02.

• The volume increased an average of 97% above 30 days with 4.27b negotiated tokens.

• Confirmed support at $ 0.21 after a new intra -trial test.

• The resistance hardened at $ 0.24 psychological threshold.

• The highest consecutive minimums point to the upward structure.

• The volume increase of 28.1ma at 04:52 GMT validates institutional flows.

What merchants are seeing

• If Doge can establish $ 0.24 as a support for a clean break towards $ 0.26.

• Continuous trends of accumulation of whales versus potential retail gains in resistance.

• Stablecoin launch impact backed by the Wyoming state on Memecoin liquidity flows.

• Future open reaction of interest after a strong rally driven by the point.