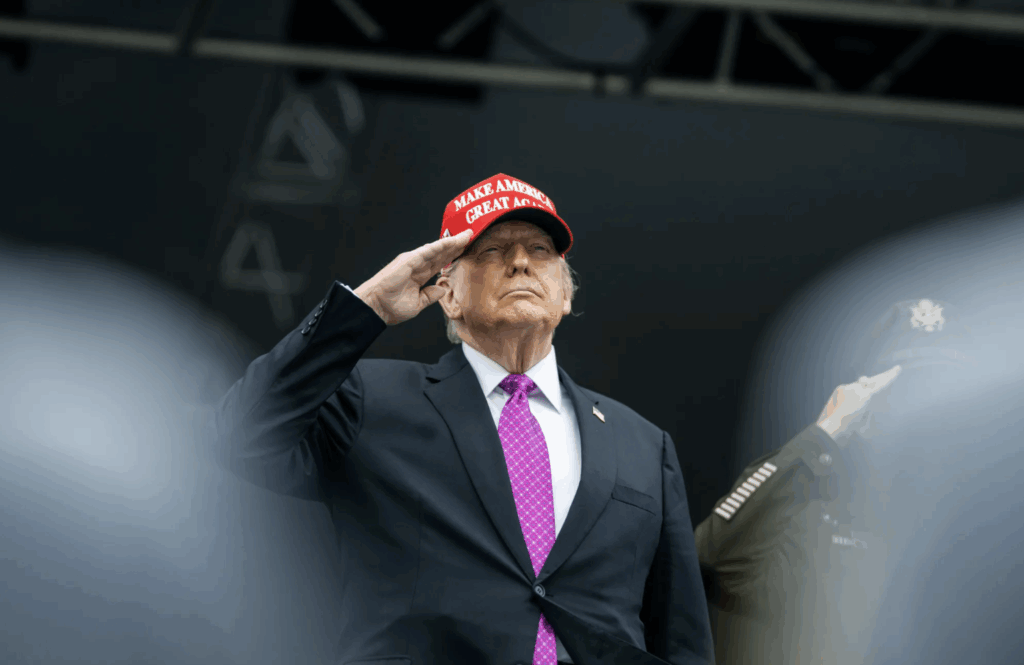

The prediction markets are indicating the skepticism that Donald Trump can bend the Federal Reserve to his will this year, even when the president of the United States moves to fire a Fed governor for what he believes is only cause.

In Polymket, the traigators put the possibility that Jerome Powell was expelled as president of the Fed in 2025 with only 10%, which suggests that investors do not believe that Trump can cancel the independence of the Central Bank before the Powell expire the term expire in May 2026.

Trump’s impulse to shoot Governor Lisa Cook tells a different story. He wants them to be eliminated by accusations of mortgage fraud, according to a letter published in Truth Social, making it the first governor sitting directed by a presidential dismissal.

However, Cook has refused to resign, arguing that “cause” movements must be applied to misconduct in office, not in private financial deals that provide their appointment.

The markets set a price of 27% of Cook’s expulsion before December 31, indicating a certain risk of legal or political consequences, but remains a solid expectation, the challenge survives.

The story shows that the previous presidents have also pressed the Fed, with the Cato Institute pointing in a 2024 piece that is more common than some would lead him to believe.

Harry Truman expelled President Thomas McCabe in 1951 to ensure debt financing in war times, Lyndon Johnson rebuked William McChesney Martin in his Texas Rancho for increasing rates during the Vietnam War, and Richard Nixon leaned strongly in Arthur Burns in the seventies After the withdrawal inflation.

A 2013 Cato Studio by Thomas F. Cargill and Gerald P. O’Driscoll Jr. argues that the independence of the Federal Reserve is more myth than reality, and points out that both parties have interfered when politically convenient.

If Trump eliminated Powell, it would certainly be controversial, but the markets could welcome him if he is considered to clean the way for a easier monetary policy. A fed more aligned with the White House could reduce rates faster, weaken the dollar and raise risk assets by widely creating a backcoin backdrop. .

Beyond the short -term manifestation, Powell’s dismissal would underline one of Crypto’s central arguments: that fiduciary systems are inherently politicians and subject to capture, while Bitcoin remains out of those pressures.

For Bitcoin, that combination of weakest liquidity conditions plus a reinforced narrative of “hard money” could be a powerful catalyst for adoption.

A change of guard in the Fed would obviously be an upward narrative for Bitcoin, so the market reaction to Trump’s movement about Cook reflects a consensus that this is largely hot air.

Bitcoin barely moved the news, 0.3% more immediate later, and the largest digital asset still fell 2.6% in the day according to Coindesk market data.

Coindesk 20, an index that tracks the performance of larger cryptographic assets, is quoted below 4,000, 5.3% less in Hong Kong time for half a day.