Digital Asset Manager Bitwise is preparing to launch a commercialized change based on change. (ETF) focused on keeping the native chainlink token The first in the United States

According to the S-1 registration statement presented to the US stock and values commission. UU. On Tuesday, the Bitwise Chainlink ETF aims to provide investors direct exhibitions to link and appointed coinbase custody as the custodian proposed for tokens.

The presentation conforms to a broader trend of asset administrators seeking to launch ETF spot focused on Altcoin in the USA. UU. As the winds against the winds against the Trump administration, after the success of Bitcoins. and ether (Eth) vehicles

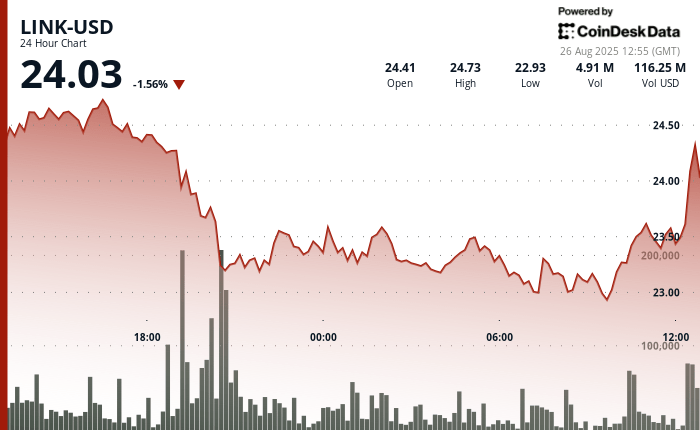

The link bounced in 5% of the night minimums in the news, but still dropped 1.6% in the last 24 hours, according to Coendesk data.

Despite the rebound, the technical analysis model of Coindesk Research suggested a sustained bearish pressure for link as the cryptography market is going through a consolidation period.

Link found a substantial pressure downward in the last 24 hours, falling from a session peak of $ 24.81 to a minimum of $ 22.90.

A remarkable recovery effort arose during the 10: 00-11: 00 UTC, coinciding with the presentation of the ETF, since the price was recovered from $ 23.02 to $ 23.54 in a high volume of 3.35 million units, indicating a possible consolidation above the crucial psychological threshold of $ 23.00.

The model suggested that claiming the level of $ 24.00 is key to stop the bassist impulse, while the recent rebound implies that overall conditions may be attracting value search investors.

Technical indicators point to the impulse down

- The price decreased 4.67% of $ 24.61 to $ 23.46 during the last 24 hours from August 25 from 12:00 to August 26 11:00 UTC.

- Negotiation range of $ 1.84 between a maximum of $ 24.81 and a minimum of $ 22.90.

- The volume increased to 6.58 million units, significantly above the average of 24 hours of 2.29 million.

- Strong resistance established around $ 24.30 with support about $ 23.00.

- Do not recover $ 24.00 indicates a continuous bearish feeling.

- Break below the support level of $ 23.40 suggests a higher risk of decline around $ 23.00.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.