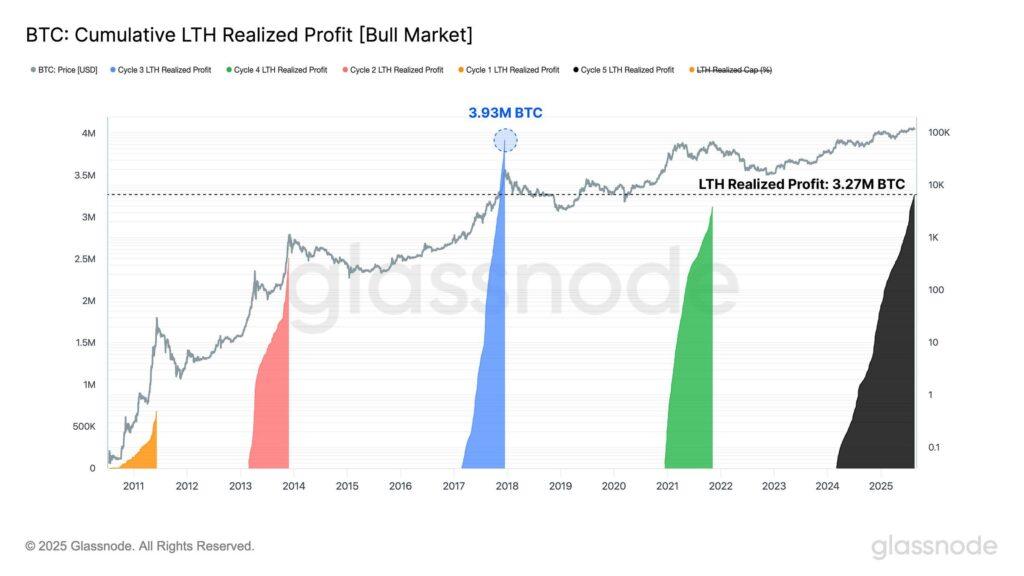

Bitcoin long -term headlines (LTHS) I have already obtained more profits in this cycle than in the entire cycle except one previous (2016 to 2017)according to the data of the Glassnode chain analysis platform.

This underlines the high pressure on the side of the sale and, when combined with other signals, suggests that the market has entered the late phase of the cycle. “

Since the beginning of 2024, Lths (Defined as investors who have had Bitcoin for at least 155 days) They have made 3.27 million BTC in profits. This figure has now overcome Toro 2021 (just over 3 million BTC) And it is far ahead of the 2013 cycle. However, the 2017 Bull Run is still followed, when the profits reached 3.93 million BTC.

For the context, Bitcoin’s average price was around $ 1,000 in 2015, compared to today that are approximately 100 times higher. This emphasizes that the market has absorbed significantly higher dollars of the profits made. The supply of the side of the sale has been enormous, with a continuous rotation of capital, even of long and latent “og” coins.

The recent market activity illustrates this dynamic: approximately 80,000 BTC were for sale in Galaxy, while another 26,000 BTC recently put themselves assets.

In total, around 100,000 BTC have gone on sale and the market has seen a slight correction, which shows how liquid the market has become. Exchange quoted funds (ETF) They have played a role in facilitation of this rotation, while commercial volumes have also expanded widely throughout the market.