Cardano’s Token rose 2% to $ 0.87 in the last 24 hours, echoing a broader recovery in cryptographic markets. The Cindeesk 20 (CD20) index, which tracks the largest digital assets, gained 2.8% during the same period.

The measure occurred when merchants weighed two main developments: growing confidence in an interest rate of September trimmed by the Federal Reserve and the United States Securities and Securities Commission. (SECOND) Decision to extend your review of the Proposed Grayscale Cardano Cardano Fund (ETF) Until the end of October 2025.

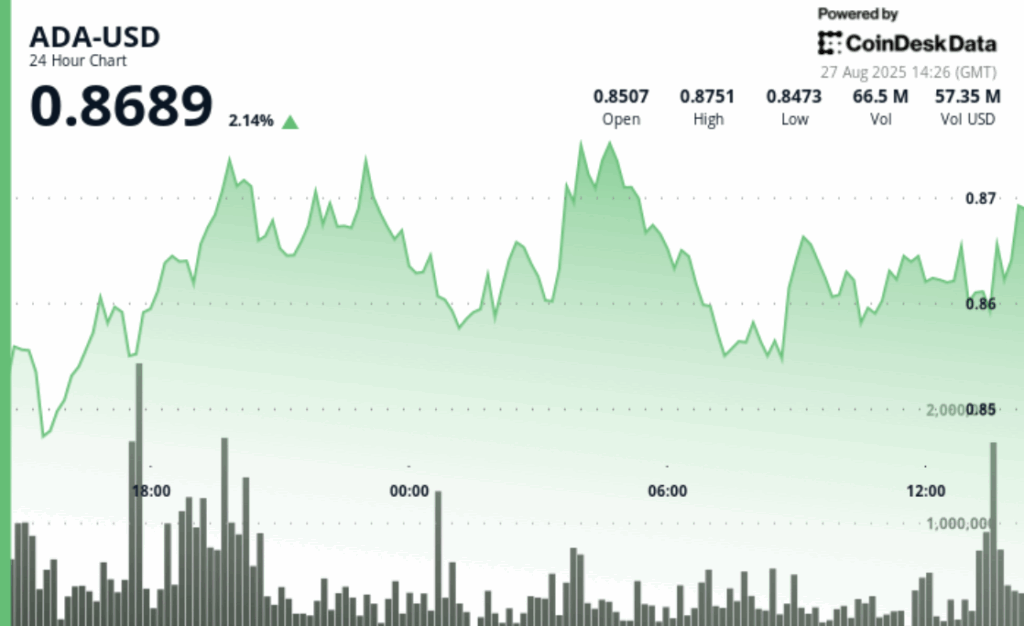

Ada quoted in an adjusted but volatile band of $ 0.04, which balanced between a minimum of $ 0.83 and a maximum of $ 0.88, according to Coindesk Analytics data. That propagation of approximately 5% reflected a high activity. At one point, the Token broke very high, increasing from $ 0.84 to $ 0.88 in negotiation volumes that doubled the average of 24 hours of 39.3 million.

After the rupture, Ada settled in consolidation. The merchants linked resistance to $ 0.88, with a new support that forms around $ 0.85. The action of the late session saw that the price would be stabilized at $ 0.86, a level that analysts say they can point to institutional accumulation before another possible rally.

The largest market backdrop has been choppy. Cryptographic assets fell sharply on Monday when merchants obtained profits from a weekend wave caused by Dovish’s comments from the president of the Fed, Jerome Powell, in Jackson Hole. These comments fed the expectations of rates cuts, which generally support risk assets such as cryptocurrencies by making traditional yields less attractive. For Tuesday, investors seemed to deal with the backward as a purchase opportunity, helping Altcoins to recover.

The lowest interest rates often act as a tail wind for the cryptographic sector, where investors seek greater yields compared to government debt. Historically, such conditions have prepared the stage for “Altcoin” periods, where smaller tokens exceed Bitcoin During consolidation phases.

Meanwhile, the delay of the SEC of the ETF Cardano de Grayscale was widely anticipated, since the regulator has slowed almost all decisions of Criptographic ETF. While the news briefly injected uncertainty, Ada’s resilience suggested that merchants focused more on the broader impulse of the market and the capital rotation of Bitcoin to Altcoins.