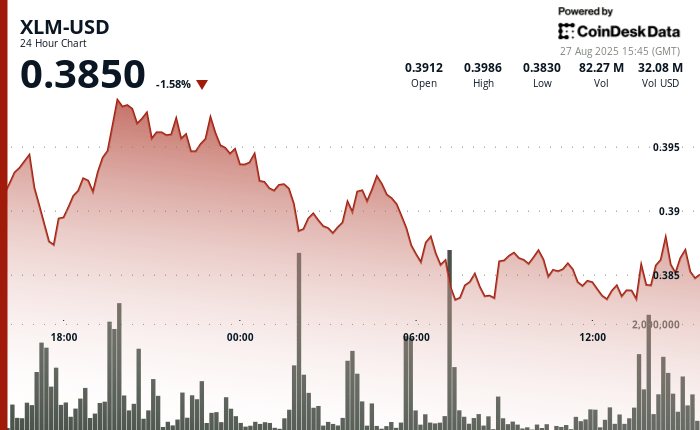

Stellar’s native token, XLM, negotiated in a narrow but active range in the last 24 hours, reflecting broader pressures throughout the digital asset market. Between August 26 at 3:00 p.m. and August 27 at 2:00 p.m., the cryptocurrency moved inside a $ 0.017 band, approximately 4%, of a maximum of $ 0.40 to a minimum of $ 0.38. After briefly trying the resistance to $ 0.40 at the end of August 26, XLM turned over $ 0.39, a 2% drop in session openings, since sellers dominated trade during the night. The volumes worked above the average in more than 45 million tokens exchanged, a sign that the institutional activity remained high despite the setback.

The increase in trade coincided with broader regulatory developments. Daily billing increased 115% to $ 402.21 million when XLM touched $ 0.40, underlining how institutional participation has intensified together with the anticipation for the possible approvals of funds quoted in cryptocurrency exchange. Recent presentations for funds linked to digital assets developed in the country, including Stellar, have helped attract corporate and institutional money to space, even when policy formulators weigh a stricter supervision.

The intradic action on August 27 offered a snapshot of that dynamic. Between 13:20 and 14:19, XLM rose from $ 0.38 to $ 0.39, earning approximately 1% in less than an hour before consolidating. The volumes reached their maximum point at 1.42 million tokens per minute during the movement, establishing technical resistance at $ 0.39 and establishing support about $ 0.38. The ability to maintain above support in the face of the most prominent aspects of gaining that institutional flows continue to shape the market structure in the short term.

Market analysis indicates a mixed feeling

- The general negotiation parameters showed a range of $ 0.017 that represents a 4% differential between the maximum $ 0.40 and the minimum levels of $ 0.38.

- The appreciation of the initial price of $ 0.39 to $ 0.40 was backed by a high negotiation volume of 41.02 million units.

- The strong resistance arose at the level of $ 0.40, which caused the subsequent sales pressure of the institutional participants.

- The extended decrease occurred with the systematic reduction of prices at closing levels of $ 0.39.

- Safe activity during the early morning presented a volume higher than the average of 45.67 million units.

- The 60 -minute concentrated period demonstrated a price movement of $ 0.38 to $ 0.39 maximum levels.

- The rupture pattern at 13:30 presented a substantial volume of 1.42 million units.

- New resistance established at $ 0.39 with technical support identified around $ 0.38.

- The final consolidation phase indicates a potential continuous institutional interest.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.