XRP abruptly withdrew after not maintaining the impulse above the resistance zone of $ 2.88– $ 2.89, even when ETF speculation continues to build before the deadlines of the October SEC.

The mass sale highlights a fundamental turning point as institutional flows fight against long -term consolidation patterns that many analysts believe they could precede a larger movement.

News history

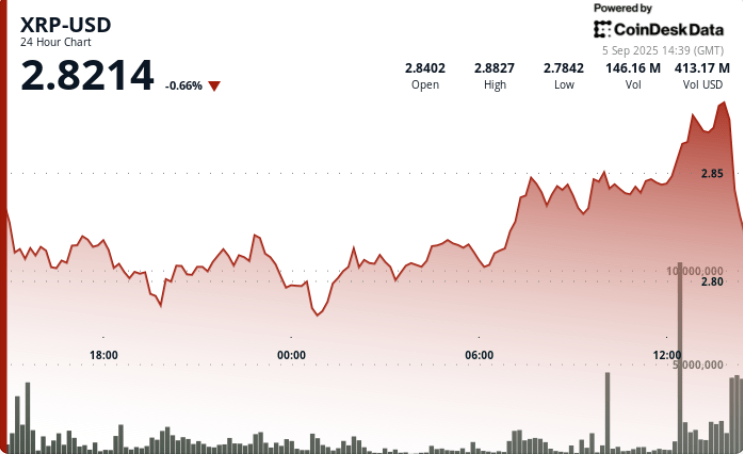

• XRP fell 4% of $ 2.88 to $ 2.84 on September 5 after reaching a maximum intradic of $ 2.89, since the institutional sales pressure arose.

• The negotiation volume exploded at 227.75 million during 12:00 hours, almost 4 times the average of 24 hours of 58.40 million.

• Six asset administrators, including the gray and bit a BIT scale, have requested the ETF Spot XRP, with decisions of the Secan Sec in October.

• Ripple’s legal agreement with SEC has improved regulatory clarity, which increases industry estimates to an 87% approval of ETF approval.

• Technical strategists are comparing the current consolidation range of 47 days with the 2017 XRP structure, which preceded a parabolic rally.

Summary of the price action

• XRP negotiated in a $ 0.10 range (3.47%) Between $ 2.78 and $ 2.89 during the 24 -hour session from September 4, 3:00 p.m. to September 5, 14:00.

• The asset advanced from $ 2.84 to $ 2.89 in a mass volume at 12:00 and 13:00 before rejecting resistance.

• A concentrated movement of 60 minutes from 13:26 to 14:25 saw a slide of 4% of $ 2.88 to $ 2.84 in a volume of 10.6m, the breach of the intradic supports at $ 2.86 and $ 2.85.

• XRP closed the session at $ 2.84, just above primary support levels about $ 2.77.

Technical analysis

• Resistance: area of $ 2.88– $ 2.89 validated after multiple failed outbreaks.

• Support: immediate levels at $ 2.84– $ 2.85, with a stronger support for $ 2.77.

• Pattern: 47 -day consolidation suggests a potential rupture configuration; $ 4.63– Objectives of $ 13 marked if the structure is resolved higher.

• Moment: RSI in the mid -50s, which shows a neutral bias; Convergent Macd Histogram towards the Crossover Alcista.

• Volume: 227.75m at the VS 58.40M average confirms the institutional distribution.

What merchants are seeing

• If $ 2.77 remains decisive support in September.

• ETF Spot XRP feelings of the SEC, seen as a possible bullish trigger.

• Continuation of whale accumulation (Tokens 340m recently added) Despite the short -term distribution pressure.

• Signs of rupture above $ 3.30, which analysts argue that they could open roads to $ 4+.