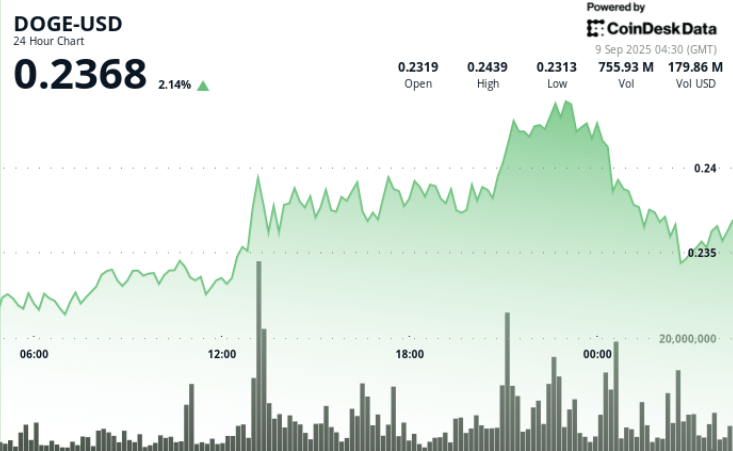

Dogecoin turned violently in the last 24 hours, with institutional whales and desks involved in heavy volumes about $ 0.234 support. The memecoin advanced 2% in the final time to recover from the pronouncement of intra -sale, although the resistance at $ 0.244 is still firm.

Summary of the price action

• Doge quoted between $ 0.231 and $ 0.244 from September 8 at 04:00 to September 9 at 03:00, a range of 5.7%.

• The early impulse brought the price at a peak of $ 0.244, but strong earnings inverted to obtain profits per closed session at $ 0.236.

• The volumes shot at 463.5m tokens during the rejection of $ 0.244, showing a strong institutional sale.

• The late session support emerged between $ 0.234– $ 0.237, with 687.9m tokens exchanged, suggesting accumulation.

• The recovery of the final time raised Doge from $ 0.234 to $ 0.237 (+1.3%) As the volume averaged 6.2m per minute.

Technical analysis

• Support: $ 0.234– $ 0.237 Zone confirmed by a large purchase in late session decreases.

• Resistance: level of $ 0.244 rejected several times in large volume, limiting the upward impulse.

• Short -term moment: the highest minimums during the last 20 minutes indicate a fresh bullish bias.

• Key signal: The rupture above $ 0.244 could point to $ 0.250, while the fault runs the risk of endangering the base of $ 0.231.

News history

• Future data show greater open interest in Doge contracts as institutions cover exposure to the point.

• Market participants anticipate the regulatory progress of the United States in cryptographic ETFs, keeping dux in speculative flows.

• The broader volatility comes from the expectations of the Fed policy and global commercial tensions that affect risk assets.

What merchants are seeing

• If Doge can sustain the closures above $ 0.240 and turn $ 0.244 in support, the opening route to $ 0.250.

• How the Fed rate decision on September 17 impacts the appetite of risk and liquidity conditions in cryptography.

• Whale whale tickets, with observed institutional desks accumulated during late session outputs.

• Progress in ETF presentations related to Doge and if regulators indicate a clearer orientation about meme coin products.