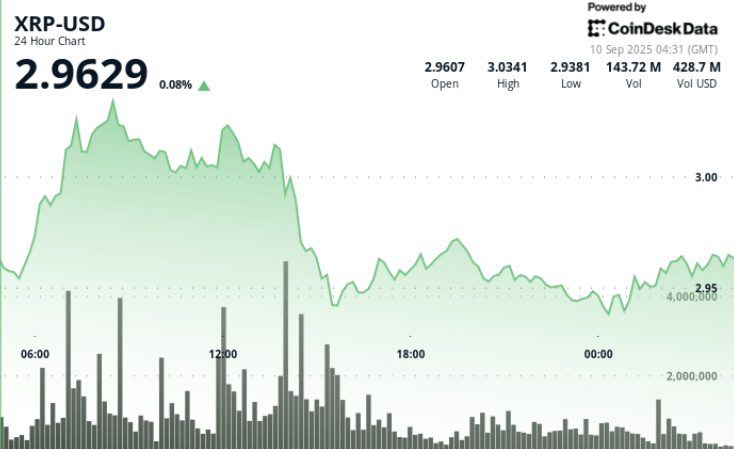

XRP fought to maintain an impulse above the threshold of $ 3.00 from September 9 to 10, with a large institutional sale that eliminates early profits. Despite an impulse to $ 3,035, the liquidation driven by the volume erased the upward attempts and withdrew the asset at $ 2.94 for closing of the session.

The movement is indicative of the assembly resistance about $ 3.02, even when merchants weigh ETF catalysts and the increase in exchange reserves that can moderate the bullish impulse.

News history

• The September 17 meeting of the Federal Reserve is expected to deliver a rate cut of 25 base points, with markets that allocate almost certainty to the result, a liquidity driving potential for risk assets.

• Six applications of ETF Spot XRP expect the review of the SEC in October, a decisions merchant considers fundamental for institutional adoption.

• Exchange custody balances for XRP reached a 12 -month peak, which raises concerns about short -term sales pressure despite whale accumulation patterns in recent weeks.

• Analysts write parallel to the July break failure of XRP, suggesting that the market structure is being tested again in the $ 3.00 barrier.

Summary of the price action

• XRP negotiated in a $ 0.10 band (2.9%) From $ 2,935 to $ 3,035 between September 9 at 03:00 and on September 10 to 02:00.

• Token advanced to $ 3,035 during morning negotiation, but faced an immediate rejection near the resistance of $ 3.02.

• A sale of 14:00 fell XRP from $ 3.018 to $ 2,956 in a volume of 165.67m, almost triple the daily average.

• The consolidated price at the closure between $ 2.94 and $ 2.96, with a modern activity with an average of 650k per minute.

Technical analysis

• Resistance: $ 3.02– $ 3.04 UPBITO level, with multiple rejections in high volume.

• Support: $ 2.94 area proven and maintained, suggesting the accumulation of institutional players.

• Moment: RSI shows early bullish divergence, but maximum exchange reserves weigh in the tracking.

• Structure: The failed break implies consolidation within $ 2.94– $ 3.00 unless the volume returns.

• Range: 3% of intradic swings highlight institutional volatility.

What merchants are seeing

• If XRP can keep closed above $ 2.95 to generate impulse for a break of $ 3.02.

• Exchange custody balances to 12 months: will tickets become sustained sales pressure?

• The decisions of October ETF of the SEC, which could act as a structural catalyst if it approves the Earth.

• The decision reduction of September 17, with the merchants positioned for their impact on the liquidity of the dollar.

• Whale tickets – 340 m tokens accumulated in recent weeks – and if the purchase of compensation exchange distribution.