Dogecoin recovered abruptly during the session from September 9 to 10, claiming the range of $ 0.24– $ 0.25 with a volume that increases above 1.5 billion tokens. The movement occurs when Rex-OSPREY prepares to debut the first ETF of the US Dogecoin on September 11 under the “Doje” ticket.

Technical merchants marked a breakdown pattern of Banderín Alcista, while the accumulation of large -scale whales was added to the growing confidence that institutional demand is being built around the launch.

News history

• Rex-OSPREY DOGE ETF is scheduled to start quoting on September 11, which makes it the first US exchange fund. Tracking a report without declared utility.

• Whale addresses accumulated approximately 280 million Dux last week, indicating strong institutional size flows.

• Technical analysts highlight a flag rupture with upward objectives of $ 0.28– $ 0.30 if the $ 0.25 level is maintained.

• ETF speculation has promoted retail enthusiasm and social networks, with Dege largely in prediction markets and derivative desks.

Summary of the price action

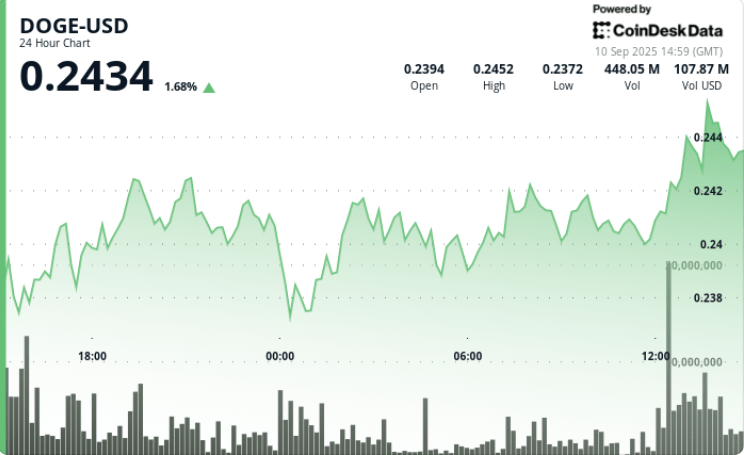

• Doge advanced 4% during the September 9 session 13: 00 – September 10, 12:00, from $ 0.236 to a peak of $ 0.245.

• The early decline saw the fall of Dux from $ 0.247 to $ 0.236 at 14:00, backed by a massive volume of 1.55b that establishes a strong floor.

• The consolidated price within $ 0.238– $ 0.242 during most of the day, which suggests a strategic accumulation.

• The rupture of the final hour lifted Doge from $ 0.240 to $ 0.245, backed by a volume of 114.7m in the peak.

• The session closed to $ 0.244, barely the resistance, confirming the uphill impulse in the ETF launch week.

Technical analysis

• Support: $ 0.236– $ 0.238 rank validated by repeated high volume rebounds.

• Resistance: $ 0.245– $ 0.247 is still the key roof; Breaking up could point to $ 0.28.

• Volume: The maximum session of 1.55b and 114.7m of late hour significantly exceeded the average of 24 hours of 334 m.

• Structure: Berin Breakout confirmed by higher minimums and accelerated volumes of the final hour.

• Indicators: RSI floating in the mid -60s suggests space for more rise before overcompra conditions arise.

What merchants are seeing

• If Dege can sustain the closures above $ 0.245 and establish a thrust towards $ 0.28.

• The launch of the ETF on September 11, is expected to be a structural liquidity event for Doge.

• Whale accumulation trends: continuous entries would validate institutional conviction.

• Positioning of derivatives such as ETF bombs, with potential for greater volatility around the launch.

• Wider feeling of the cryptocurrency market linked to the federal reserve policy decisions later in the month.