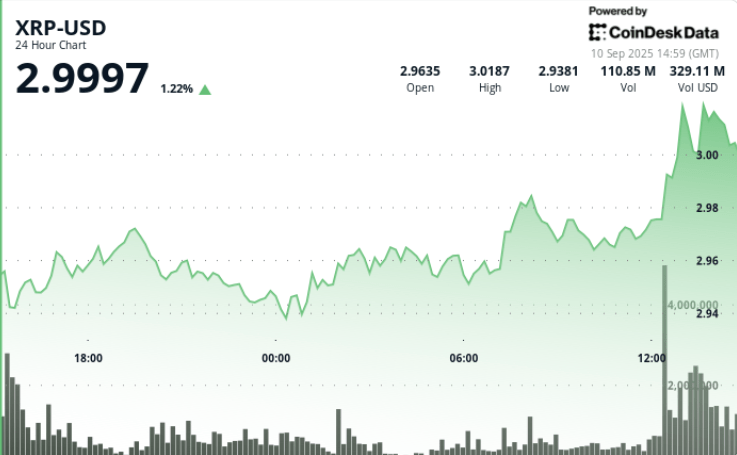

XRP exceeded the threshold of $ 3 during the session from September 9 to 10 as institutional flows accelerated in the back of regulatory clarity in Europe.

The new Ripple Association with BBVA under the fulfillment of Mica fed the optimism that traditional banks can deepen the adoption of blockchain settlement.

While Bulls defended the support of $ 2.99, analysts notice that Exchange Rising reserves could still weigh on the sustained rise impulse.

News history

• Ripple Labs announced an expanded association with BBVA, which allows asset custody solutions and liquidation of digital assets under the EU MICA compliance standards.

• The institutional speculation of the ETF continues in the USA., With the merchants that set the decisions of October SEC as a possible structural catalyst.

• Derivative merchants show a strong bullish positioning with Put call relationships of 3 to 1 concentrates between $ 2.90 and $ 3.50 at the expiration of September 12.

• XRP exchange reserves increased to 12 months maximum, which suggests a potential distribution pressure despite the strong news of association.

Summary of the price action

• XRP rose from $ 2.97 to $ 3.02 during September 9, 15: 00 – September 10, 14:00, marking an 8%gain.

• High session reached $ 3.02 during window 13: 47–13: 48 with volume peaks of 4.36my 3.44m.

• Consolidated support at $ 2.94– $ 2.95 in a solid volume validation.

• The Token defended $ 3.00 despite intradic immersion at $ 2.99, pointing out the institutional defense.

• Closing price of $ 3.01– $ 3.02 kept XRP within the Alcista continuation zone.

Technical analysis

• Volume: Picos of 116.76my 119.07m during the waves, almost 3 times a daily average of 42.18m.

• Support: solid base at $ 2.94– $ 2.95; Multiple successful reestimations confirm accumulation.

• Resistance: break over $ 3.00 validated; The following upward levels are at $ 3.05– $ 3.10 Fibonacci extension.

• Moment: The highest minimums in Breakout reinforce the institutional purchase interest.

• Structure: The rupture of the consolidation zone suggests continuous potential if the $ 3.00 floor is maintained.

What merchants are seeing

• If XRP can keep closes daily above $ 3.00 to confirm the strength of the break.

• October ETF decisions as a structural catalyst for institutional capital entries.

• Expiration options on September 12, where heavy call positioning could amplify volatility.

• Exchange reserves rise to 12 months maximum: will tickets be inclined towards sustained sales pressure?

• Monitoring of the BBVA-Ripple Association as a sign for European bank adoption.