Operators are using leverage in an attempt to lift Bitcoin Back to registered maximums, creating a high -risk environment that could result in a derivative that relax in the disadvantage if the price begins to change in the future.

The market analyst SKEW warned an operator with the intention of opening a nine -digit position to “may wait for Spot to carry the purchase so that he does not believe toxic flows.”

The Bears are also adding leverage, with a separate merchant who currently deal with an unrealized loss of $ 7.5 million after shortening BTC for a sum of $ 234 million with an entrance at $ 111,386. That merchant added $ 10 million in Stablecoins to maintain its position, with the liquidation currently at $ 121,510.

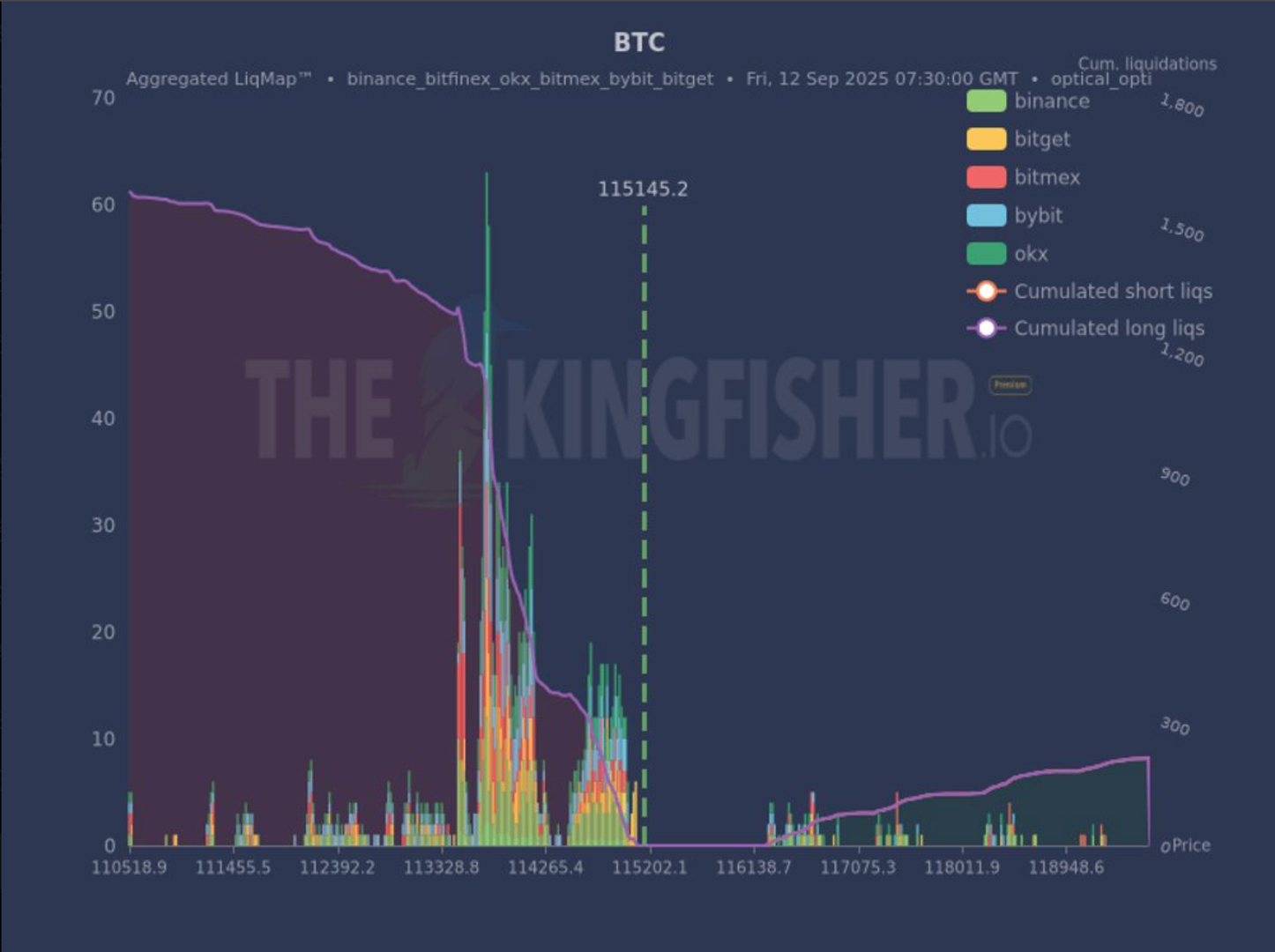

But the main risk of liquidation is present in the inconvenience, with the data of Martín Pescador that show a large pocket of derivatives will be settled between $ 113,300 and $ 114,500, which could boost a liquidation waterfall at the support level of $ 110,000.

“This picture shows where merchants are overheated,” the Kingfisher wrote. “It is a pain map. The price tends to be absorbed by these areas to clarify positions. Use these data so that it does not end on the wrong side of a great movement.”

Bitcoin currently quietly quotes around $ 115,000 after having entered a period of low volatility, without getting out of its current range for more than two months.