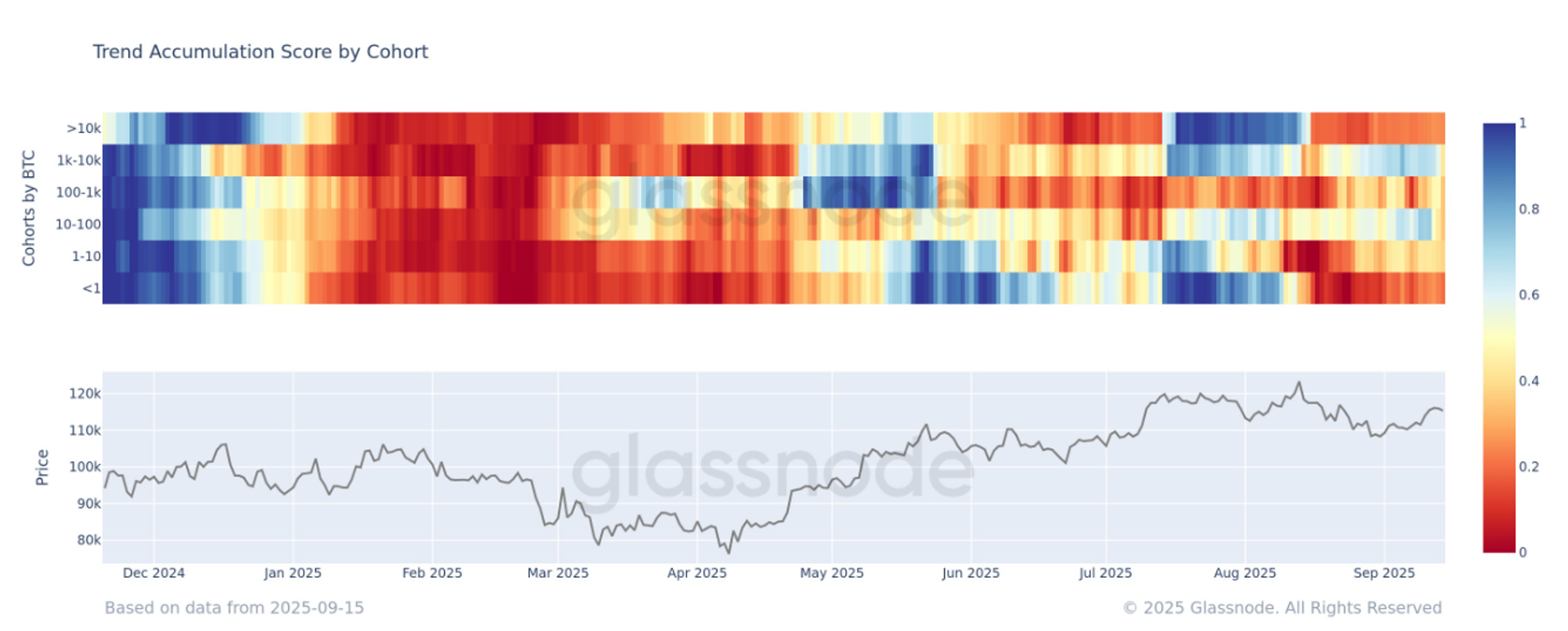

Glassnode data show that all wallet cohorts have returned to the mode of distribution, with a net sale of Bitcoin, according to the breakdown of the score of the accumulation trend by the wallet cohort.

This metric disaggregates the accumulation trend score to show the relative behavior of different wallet groups. It measures the resistance of the accumulation for each equilibrium size depending on the size of the entities and the volume of currencies acquired in the last 15 days. (For more details about the methodology, consult this entry of the Academy).

- A value closer to 1 signs of accumulation by that cohort.

- A value closer to 0 signal distribution.

Exchanges, miners and other similar entities are excluded from calculation.

Currently, all cohorts, from wallets that have less than one bitcoin to those who have more than 10,000, are net sellers. This follows the rally last week, when some whales, especially the 10-100 BTC and 1,000-10,000 BTC cohorts were buying. Since then, they have returned to the sale.

Bitcoin was recently floating about $ 117,000 after the Asian negotiation session raised it from $ 115,000 during the weekend. In the last three months, Asia has constantly conducted Bitcoin approximately 10 percent higher, according to veil data. In contrast, the European trade session has been marked by setbacks, which has been seen on Monday so far. In addition, Bitcoin has dropped more than 10% in the EU market in the last three months.

In general, the market remains in consolidation, a trend that probably persists until September. In current data, the $ 107,000 marked in early September still seems to be the most likely fund.