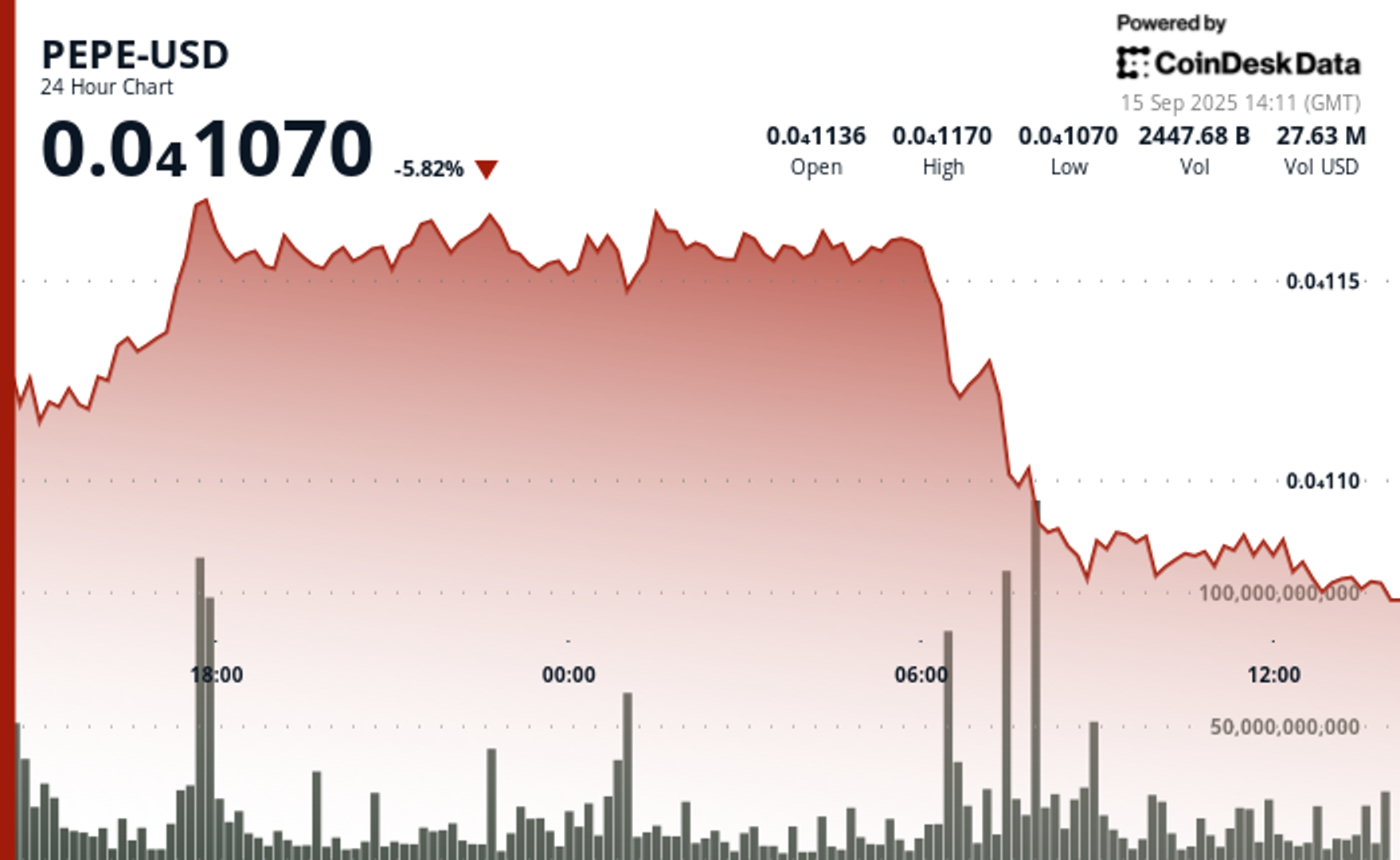

The cryptocurrency inspired by Meme Pepe has lost almost 6% of its value in the last 24 -hour period, sliding to a minimum of $ 0.0000107 even when large investors accumulate.

Volume trade due to cryptocurrency increased in the billion tokens in the middle of the fall, since the Token still did not find support in the midst of the intense sales pressure. The fall came in the middle of a large (CD20) The index lost 1.8% of its value.

Memecoins were especially difficult in mass sale. COINDESK MEMECOIN INDEX It fell almost 5% in the last 24 hours, while Bitcoin saw a 0.8% drop.

The fall occurs a few days after the speculation of the Altcoin season grew between the cryptocurrency circles on the expected cut of the Federal Reserve interest rate at the end of this week, which is expected to be a blessing for risk assets.

Nansen’s data show that during the past week, the 100 main addresses that are not exchange that have Pepe in the Ethereum network have seen their holdings from 1.38% grow to 307.33 billion tokens, while exchange wallets had a 1.45% drop in holdings to 254.4 billion tokens.

General description of the technical analysis

Pepe’s price action pointed out a retirement market, according to the Coindensk Research technical analysis data model. The Token fell from $ 0.000011484 to $ 0.000010782, with vendors dominating the graph.

The price reached a maximum of $ 0.000011732 during a resistance test, but the volume increased to 5.5 billion tokens at that level, before the market was finally reduced.

The support showed signs of buckling during the next phase, with the Token brushing against $ 0.000010746. The commercial activity intensified again, reaching 7.7 billion tokens and reinforcing the bearish feeling.

The price of cryptocurrency hit an intra -range of 9%, a sign that merchants are not sure if the support levels will maintain.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.