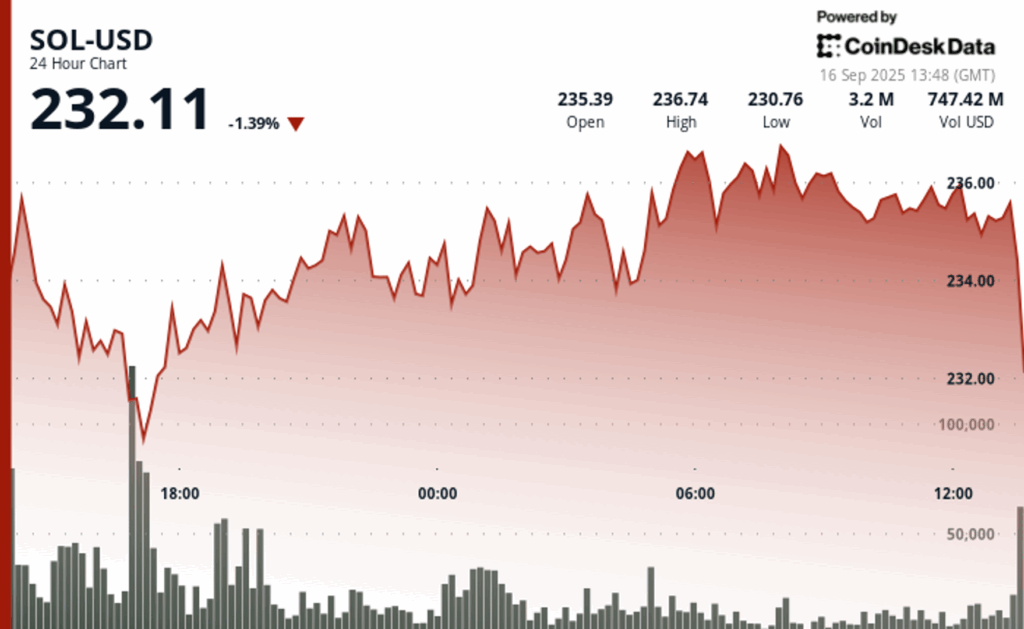

According to Coindesk data, Sol de Solana traded at $ 232.11 at 12:30 UTC on September 16, keeping relatively firm after a broken day that saw the prices of prices of $ 230 and $ 238.

Analyst view

Altcoin Sherpa, a merchant widely followed, said today that he sees Sol and BNB as stronger bets than ETH. He pointed out that new financing flows and market structures seem more sun -oriented, while ETH has already made a substantial race and may need time to consolidate.

He added that students still move in step with BTC: if BTC weakens, it is unlikely that Sol, BNB or ETH will continue to increase. But if Bitcoin meets with positive macro developments, he hopes that the elderly will continue, with Sol and BNB probably lead in performance. Sherpa said that both sun and BNB remains long, while its ether position is relatively small.

Technical Analysis of COINDESK Research

According to the technical analysis data model of Coindesk Research, Sol was negotiated within a range of $ 8 during the analysis window from September 15 to 16, moving between a maximum of $ 238.09 and a minimum of $ 230.13.

The heaviest sale occurred between 12:00 and 5:00 p.m. UTC on September 15, when Sol slid almost $ 8 from the peak on the channel. The volume increased to 1.5 million units during this decline, marking intense sales pressure.

Subsequently, the buyers repeatedly defended the $ 233– $ 234 area, establishing a short -term “floor”. Sol consolidated with the participation of around 650,000 units of volume, which suggests a combination of institutional distribution and retail accumulation.

Towards the end of the session, the price action improved. Between 07:00 and 08:00 UTC of September 16, Sol left a narrow band of $ 235.52– $ 236.50, briefly rising to $ 236.90 in a peak of 46,000 units in just a few minutes. This increase exceeded the price towards a resistance zone of $ 237.50– $ 238 before the impulse cooled.

In general, the data show that Sol is stabilized after sharp swings, with a clear support base about $ 233 and a roof that forms between $ 237.50 and $ 238.

Last analysis of the 24 -hour table and one month

The last 24 -hour Coendesk data picture, which ends at 12:30 UTC on September 16, shows Sol to $ 232.11 after withdrawing from an intradic area of $ 236– $ 237. Trade was reduced in the $ 232– $ 234 band, reinforcing that area as a short -term support.

The one -month graph shows that Sol still has an upward trend in general, although the recent setback that Sol is testing its support base instead of extending the profits. Consolidation suggests that token may need to obtain impulse before another higher attempt.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.