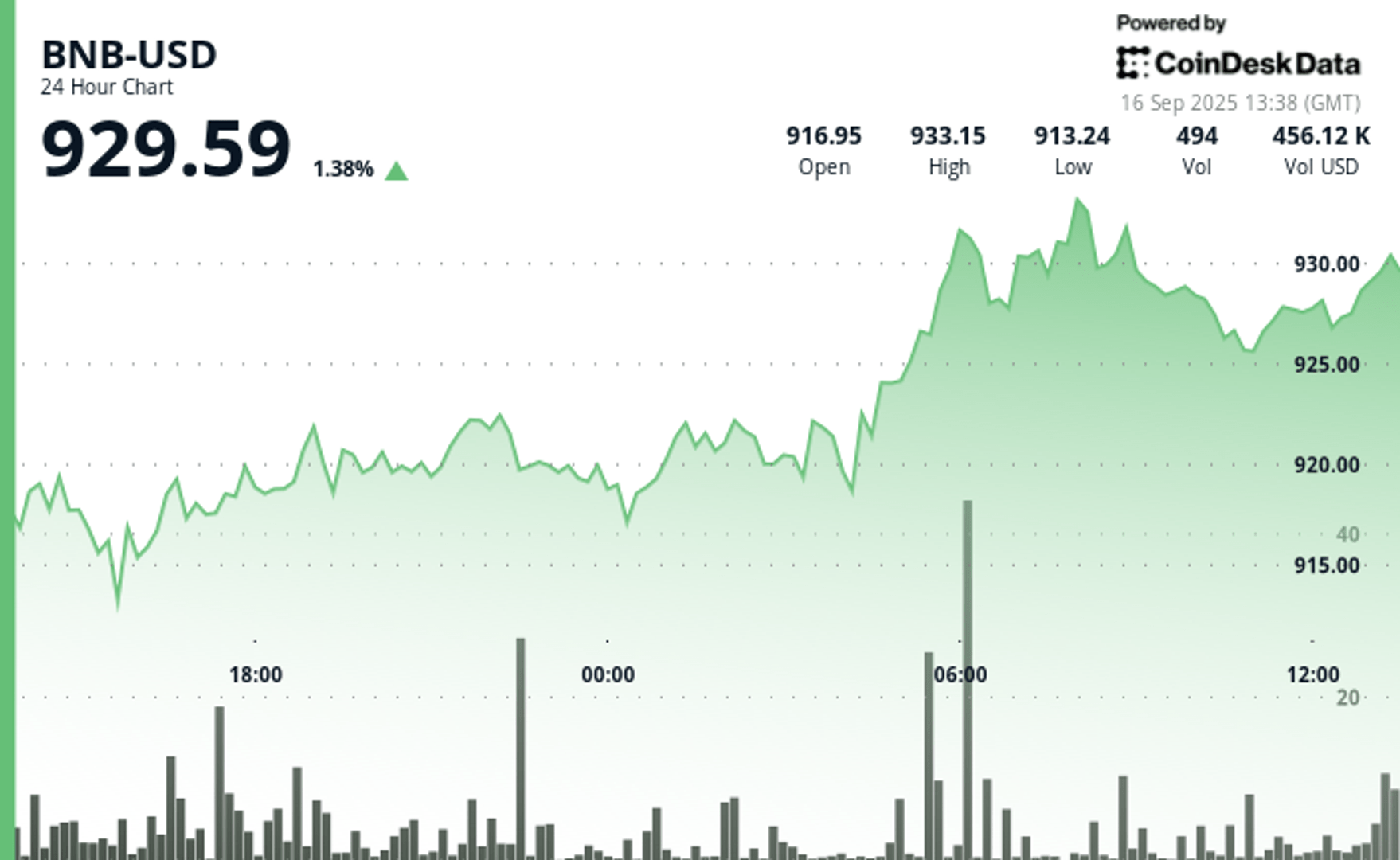

BNB increased 1.4% in the last 24 hours as investors increased exposure to cryptocurrency market. The price of BNB rose to $ 933.03 through a series of large volume transactions that pierced technical resistance, according to the technical analysis model of Coindesk Research.

The increase, part of a broader movement, reflects the growing interest of market participants that are positioned before a possible change in the interest rates of the United States. The CME Fedwatch tool shows a 96% probability of a 25 BPS reduction on Wednesday and a 5% probability of a 50 BPS cut. In Polymket, operators weigh 92% of smaller cuts and 7% possibilities of the largest.

BSTA data shows that corporate treasure bonds now have about 828,900 BNB, with a value of approximately $ 770 million at current prices, while several companies have pledged to continue accumulating the cryptocurrency. The largest corporate head of BNB is CEA Industries, with 389,000 tokens in its treasure.

The merchants observed signs of accumulation as prices remained stable in the low $ 910 before breaking briefly above $ 930. BNB is currently testing that resistance level again.

The ascending impulse has moved constantly during the session, with coordinated volume peaks that confirm that the interest was not isolated.

The cryptocurrency, which can be used for discounts on transaction rates in the leader of the leader cryptocurrency exchange or within the BNB chain ecosystem, has remained a leader among the exchange tokens.

It currently represents 81% of the total market capitalization of the sector, and together with the Kucoin KCS it is close to a maximum cryptoculars of all time.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.