Ethereum is in the middle of a paradox. Even when Ether reached maximum record at the end of August, the activity of decentralized finances (defi) in the Ethereum Capa-1 (L1) seems silenced compared to its peak at the end of 2021. The rates collected in Mainnet in August were only $ 44 million, a 44% drop in the previous month.

Meanwhile, layer 2 (L2) networks such as the referee and the base are booming, with $ 20 billion and $ 15 billion in total blocked value (TVL) respectively.

This divergence raises a crucial question: Are L2 cannibalizing the defi activity of Ethereum, or the ecosystem is evolving a financial architecture of several layers?

AJ Warner, the director of Offchain Labs strategy, the developer firm behind the referee of layer 2, argues that the metrics are more nuanced than only the defense of layer 2 in layer 1.

In an interview with Coindesk, Warner said that focusing only on TVL loses the point, and that Ethereum works more and more like the “Crypto global settlement layer”, a basis for high value issuance and institutional activity. Products such as Franklin Templeton tokenized funds or the launch of Blackrock Buidl products directly in Ethereum L1, an activity that is not completely captured in Metric Defi, but underlines Ethereum’s role as the basis of cryptographic financing.

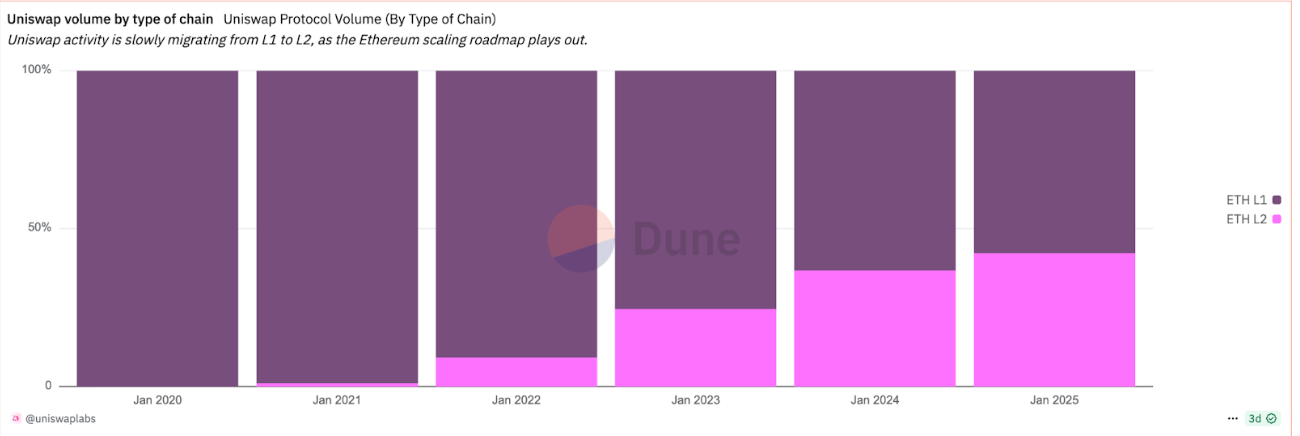

Ethereum as layer block chain 1 is the safe base network but relatively slow and expensive. The layers-2 are climbing nets built on it, designed to handle transactions faster and a cost fraction before Ethereum is finally resolved to obtain safety. That is why they have become so attractive for both merchants and builders. The metrics such as TVL, the amount of cryptography deposited in the Defi protocols, highlight this change, as the activity moves to L2S, where the lowest rates and faster confirmations make the daily defi quite more practical.

Warner compares Ethereum’s place in the ecosystem to a transfer of cables in traditional finance: reliable, safe and used for large -scale settlement. However, everyday transactions are migrating to L2S: the venms and payals of crypto.

“Ethereum was never going to be a monolithic block chain with all the activity that happened in it,” Warner told Coindesk. On the other hand, it is intended to anchor safety while allowing the rolls to run faster, faster and more diverse applications.

Capa 2, which has exploded in recent years because they are considered the fastest and most cheap alternative to Ethereum, allow complete defi categories that do not work so well in Mainnet. Commercial rapid rhythm strategies, such as arbitration price differences between exchanges or the operation of perpetual futures, do not work well in the slower blocks of Ethereum of 12 seconds. But in the referee, where transactions are ended in less than a second, those same strategies become possible, Warner explained. This is evident, since Ethereum has had less than 50 million transactions in the last month, compared to the 328 million base transactions and the 77 million arbitration transactions, according to L2Beat.

Constructors also see L2S as an ideal testing field. Alice Hou, Messari’s research analyst, said innovations such as UNISWAP V4 hooks, customizable characteristics that can be expedited with much cheaper in L2S before going to the mainstream. For developers, faster confirmations and lower costs are more than convenience: they expand what is possible.

“The L2S provide a natural recreation patio to test this type of innovations, and once a hook achieves the popularity of the rupture, it could attract new types of users who get involved with Defi so that they were not feasible in L1,” said Hou.

But change is not just about technology. Liquidity suppliers are responding to incentives. HOU However, larger liquidity suppliers are still grouped in Ethereum, prioritizing the safety and depth of liquidity over greater returns.

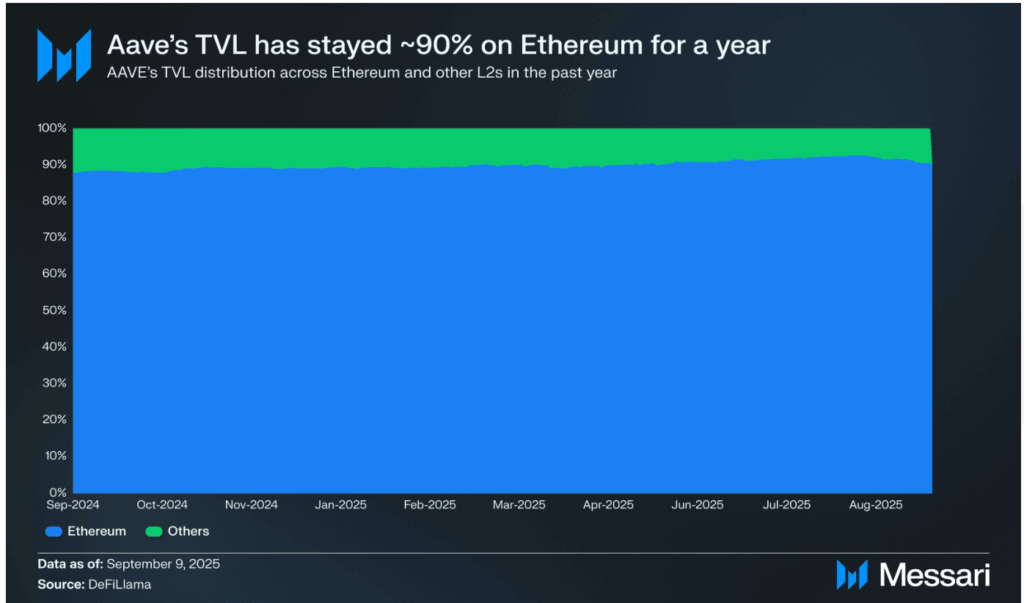

Interestingly, while L2 are capturing more activity, Defi Insignia protocols such as Aave and Uniswap still lean strongly in Mainnet. Aave has constantly maintained around 90% of its TVL in Ethereum. However, with Uniswap, there has been an incremental change towards the activity of L2.

Another factor that accelerates the adoption of L2 is the user experience. Founded wallets, bridges and ramps increasingly lead to newcomers directly to L2S, Hou said. Ultimately, the data suggests that the debate L1 vs. L2 is not zero.

As of September 2025, approximately one third of L2 TVL is still bridged from Ethereum, another third is natively coined and the rest comes through external bridges.

“This mixture shows that, although Ethereum remains a key source of liquidity, L2 are also developing their own native ecosystems and attracting cross -chain assets,” said Hou.

Ethereum, therefore, as a base layer seems to be cementing as the safe settlement engine for global finance, while the rolls such as the referee and the base are emerging as execution layers for rapid, cheap and creative applications.

“Most of the payments I make use something like Zelle or Paypal … but when I bought my house, I used a cable. That is something parallel to what is happening between the Ethereum layer and two of the layer,” Warner of Offchain Labs said.

Read more: Ethereum defi is left behind, even when the ether price crosses the maximum records