Islamabad:

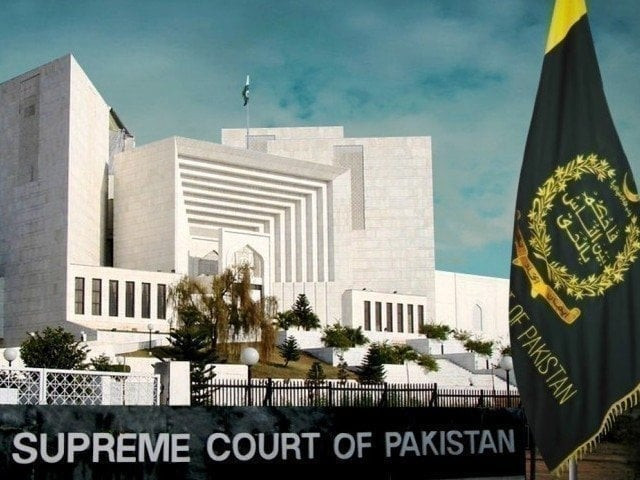

The Supreme Court continued hearings on requests that defy the super taxes, since the Federal Income Board (FBR) defended the authority of the Parliament to impose the tax.

A Constitutional Bank of five members headed by Judge Aminuddin Khan heard arguments of FBB’s lawyer Ehsan Khokhar, who argued that Section 14 of the Finance Law had not been changed, “only its altered purpose.”

He argued that the case did not raise issues of legislative competence, adding that taxpayers who had not submitted statements were now “looking for benefits” through litigation.

However, Judge Jamal Khan Commandkhail pressed Khokhar about whether the National Assembly could approve a tax bill outside the annual budget cycle. “The Constitution has specifically granted this power to Parliament?” asked.

Khokhar replied that there was a precedent, even in the case of practice and procedure 63-A, and emphasized that the ruling of the Superior Court of Islamabad (IHC) that hit parts of the tax was “contradictory and not legally sustainable.”

“Either the Parliament or the Supreme Court, each institution is obliged under the Constitution,” Judge Commandkhail observed, emphasizing that the higher courts were obliged to follow the judgments of the Apex court. The arguments of lawyer Senior Ashter Ausaf began after Khokhar concluded.

Towards the end of the hearing, the additional attorney general and the lawyer of the companies, Makhdoom Ali Khan, approached the gallery.

The additional attorney general informed the Bank that the Attorney General would not present oral arguments and, on the other hand, would present arguments written in two days.

Makhdoom Ali Khan, however, opposed, saying that he could not proceed until those presentations were registered.