Dogecoin’s price action (Doge) this week has activated bargain hunters.

The largest memes token by market value, Dogecoin, has fallen almost 5% to 26 cents, according to Coendesk data. However, institutional investors are taking advantage of the opportunity, taking advantage of 680 million tokens amid the price drop.

This burst of accumulation occurs as regulatory clarity improves before the early approval of the first ETF of the USA spot spot. UU., According to CD Analytics.

On Tuesday, Cleancore Solutions announced the purchase of 100 million additional duxes, carrying their treasure holdings to more than 600 million Duxt.

The ETF (Doje) of Rex Shares-OSPREY Dogecoin is expected to be activated this week, allowing investors to obtain exposure to cryptocurrency without the need to possess and store it.

Key insights

- The corporate interest in Dogecoin intensified during the period from September 16 to 17, since the institutional accumulation and the regulatory developments surrounding the proposals of funds quoted in the stock exchange created new investment parameters.

- The corporate trade desks monitored the Doge range of $ 0.01, which represents a 5% volatility between $ 0.27 resistance and support levels of $ 0.26.

- Institutional sale aimed at $ 0.26, driven by an exceptional volume of 945.89 million, established corporate support parameters. The nocturnal institutional purchase created resistance around $ 0.27 in a volume of 629.60 million, indicating corporate accumulation strategies.

- Support confirmation based on the volume at the level of $ 0.26, after an immediate institutional recovery, validated the corporate adoption thesis.

- The resilience of the critical support zone during the 60 -minute sales pressure demonstrates the institutional commitment to current price levels.

- A technical rupture of a consolidation pattern of several months attracts the attention of the corporate treasure, with a price objective of $ 0.50.

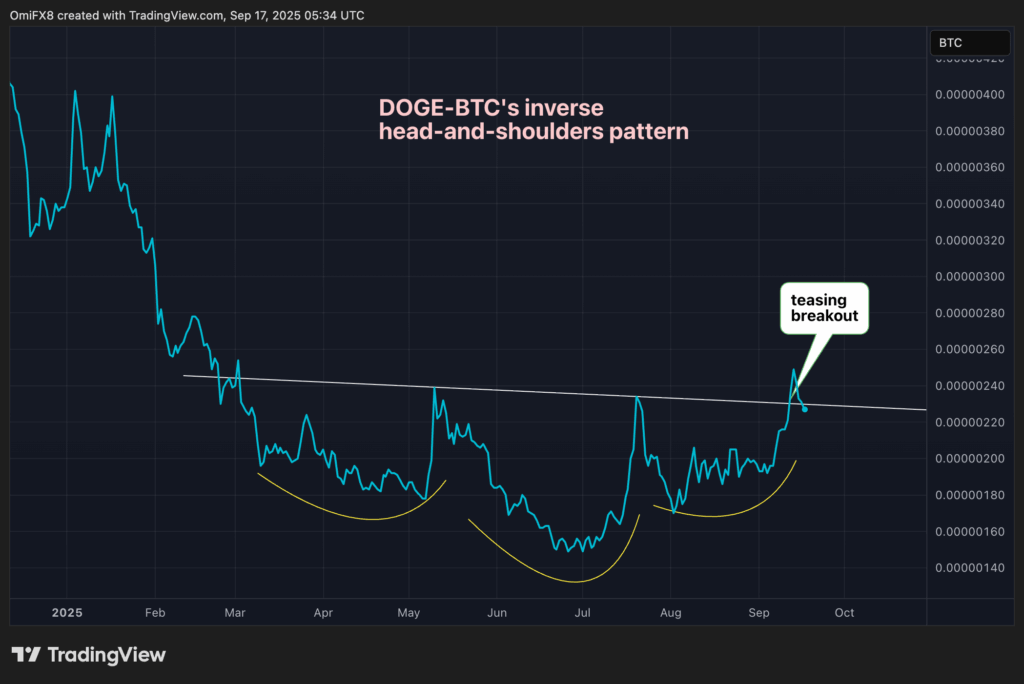

Focus on doge/BTC

The Dogecoin-bitcoin ratio that is quoted in Binance (Dobe/BTC) could see acute profits, assuming that Fed cuts rates were expected on Wednesday, while feeling the foundations for aggressive flexibility in the coming months.

This is because the Doge-BTC ratio has forged a bullish inverse head and shoulder pattern. In other words, the stage is prepared for a Dux Rally in relation to BTC.

The Federal Reserve is expected to reduce interest rates at 25 basic points at 4% later on Wednesday. With the price of merchants in a 99% probability of this movement, it is essentially baked to the market.

That means that the approach now changes to what the Fed indicates about future cuts. Doge Bulls will wait for the Fed to minimize inflation concerns, hinting at faster and faster and aggressive rate reductions in the coming months.