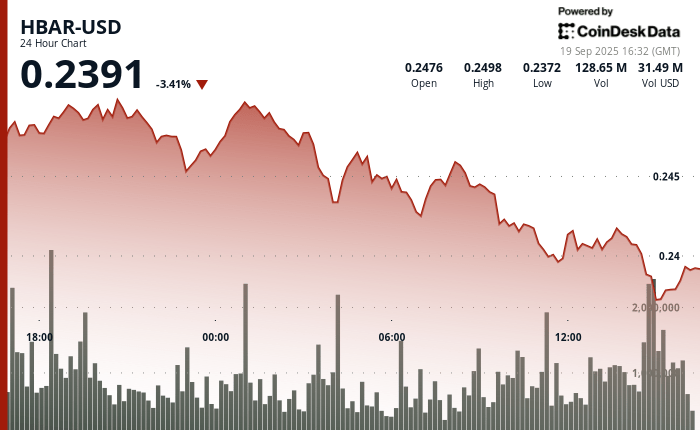

Hbar faced a constant downward pressure in the last 23 hours, sliding from $ 0.25 to $ 0.24, a 3.38%decrease. The Token initially tried to generate impulse on September 18, reaching $ 0.25 at 20:00, but sellers quickly overwhelmed the demand near that level of resistance. Commercial activity increased at 19:00 with volumes that exceed 55.91 million, which underlines the intensity of the sale. At the end of the night, Hbar broke below the key support areas at $ 0.25 and $ 0.24, testing the lower limit before finding temporary stability.

The setback highlights the short -term fragile feeling, with the bears that maintain control since buyers could not defend the critical thresholds. The inability to recover the lost land indicates that market participants remain cautious, although consolidation about $ 0.24 suggests some stabilization. If the level continues to be maintained, merchants can see it as a basis for a possible lateral movement before a clearer directional trend arises.

The broader market factors continue to shape Hbar’s prospects. While its hashgraph technology of energy efficiency is often cited as a competitive advantage over traditional block chains, the volume trade still lags like Solana. Even so, the institutional guarantees of Google, IBM and Boeing offer a degree of legitimacy that could attract investors looking for blockchain projects promoted by public services. Its low -cost and high speed transactions keep HBAR positioned as a contender in the evolutionary digital asset panorama.

In the last hour of the session observed, Hbar showed signs of stabilization, closely floating around $ 0.24. The Token formed a minor ascending triangle pattern, testing the support several times while pushing slightly up. Although modest, this recovery in the volume of 2.08 million indicates that buyers are going back.

Evaluation of technical indicators

- Hbar violated multiple support levels, including $ 0.25 and $ 0.24 throughout the bearish phase.

- 55.91 million volume during intensified pressure intensified settlement from 7:00 p.m.

- Ascending triangular pattern formation with higher progressive minimums established at $ 0.24, $ 0.24 and $ 0.24.

- The resistance remained consistent around $ 0.24, which suggests potential for rupture above this threshold.

- Recent stabilization about $ 0.24 may indicate prospective consolidation that precedes the subsequent directional movement.

- The technical analysis reveals a constructive consolidation pattern with successful support exams.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.