Much has been done from the low yield from Bitcoin to Gold, who arrived on Tuesday to another in a long series of records, which crosses over $ 3,800 per ounce for the first time. But Gold is not the only party asset, while Bitcoin stagnates for less than $ 115,000.

The US shares have also been record notches in what appears to be daily, including the Bellwether S&P 500 index, which perches just below the 6,700 level.

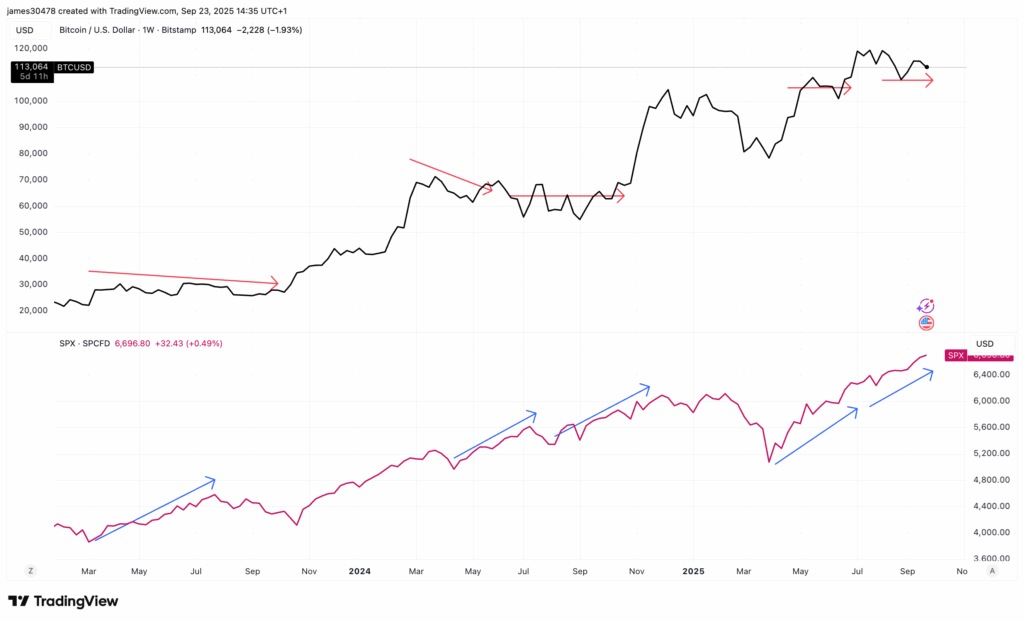

Even with BTC fighting in recent times, the largest cryptography in the world remains in a bullish market and this is not the first time that this cycle has been diverged from the S&P 500.

The first divergence occurred between March and July 2024. During this period, the S&P 500 rose around 4,000 to 4,600, while Bitcoin decreased from just under $ 30,000 to $ 25,000.

The second divergence took place later that year when the S&P 500 recovered from 5,200 to 6,000 from April to October. With only a brief summer pause. Bitcoin, however, did not continue, with his rally not starting until November (together with the results of the presidential elections).

As for this most recent divergence, the S&P 500 since May has moved constantly, while Bitcoin has established within the range of $ 110,000 to $ 120,000. Bitcoin broke into new maximums of all time in August, but those profits were quickly invested, with BTC returning to the lower end of its previous range.

The story suggests that while Bitcoin and the S&P 500 often move in the same general direction, diverge periodically for prolonged periods. The data of at least this current cycle suggests that Bitcoin is probable to update with gold.