The broader cryptographic feeling remained fragile amid risk flows, although Dege showed resilience with consistent liquidity inputs.

News history

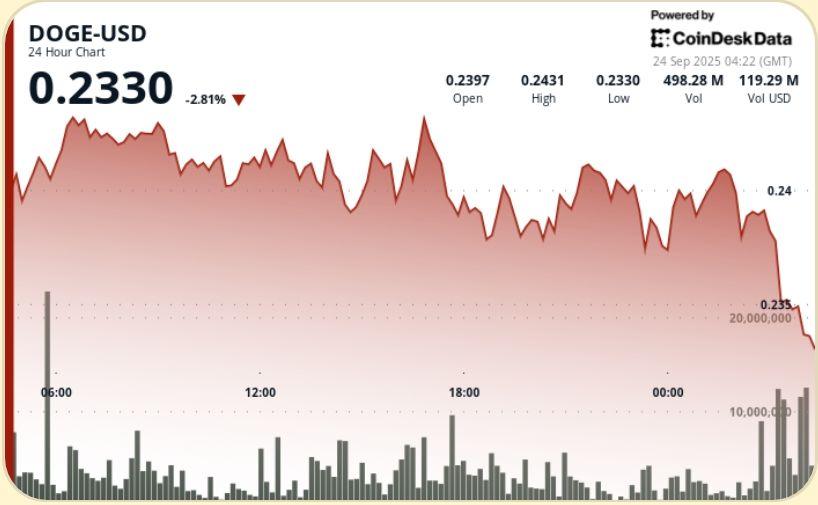

Consolidated in a tight band during the 24 -hour window from September 23 at 03:00 to September 24 at 02:00, quoting between $ 0.236 and $ 0.244. The first demonstrations at 06:00 and 16:00 tested the $ 0.244 mark, but the repeated profits limited the upward impulse.

Summary of the price action

• Doge fluctuated in a range of $ 0.008, equal to 3.28% of its negotiation spectrum.

• The first maximums of the session tested $ 0.244, but met with sustained sales pressure.

• Final session time (01: 11–02: 10) He saw Doge move from $ 0.239 to $ 0.241 before consolidating $ 0.240.

• Net session gain of 1.37% of $ 0.237 open at $ 0.240 underline the defensive offer despite volatility.

Technical analysis

• Support: a solid base formed at $ 0.236– $ 0.240 area with buyers intervening in the casualties.

• Resistance: $ 0.241– $ 0.244 is still a firm roof after multiple rejections.

• Volume: more than 500 m doge made during the first manifestations; Spike closing time above 7M highlighted the bullish defense.

• Pattern: narrow consolidation suggests a potential rolling for rupture, although resistance at $ 0.244 must erase for the continuation.

What merchants are seeing

• Break above $ 0.244 resistance to validate the upward continuation.

• Valocity of $ 0.236– $ 0.240 Support for signs of accumulation versus exhaustion.

• Sustainability of the volume: if the closing hours are repeated in the next sessions.

• The broader memecoin feeling as regulatory developments weigh on speculative assets.