It remains stagnant in the range of $ 110,000 to $ 120,000, while gold and US shares. Near the historical maximums.

According to the Cohort Glassnode accumulation trend score, the sales pressure is evident in all wallet groups. This metric measures the relative force of accumulation based on the size of the entities and the volume of currencies acquired in the last 15 days. A value closer to the accumulation of signals of 1, while a value closer to the distribution of 0 signals. Exchanges and miners are excluded from this calculation.

Currently, each cohort, from wallets that hold less than 1 BTC to whales that have more than 10,000 BTC, is in distribution. The largest whales, with holdings exceeding 10,000 BTC, show some of the most aggressive sales levels during the past year.

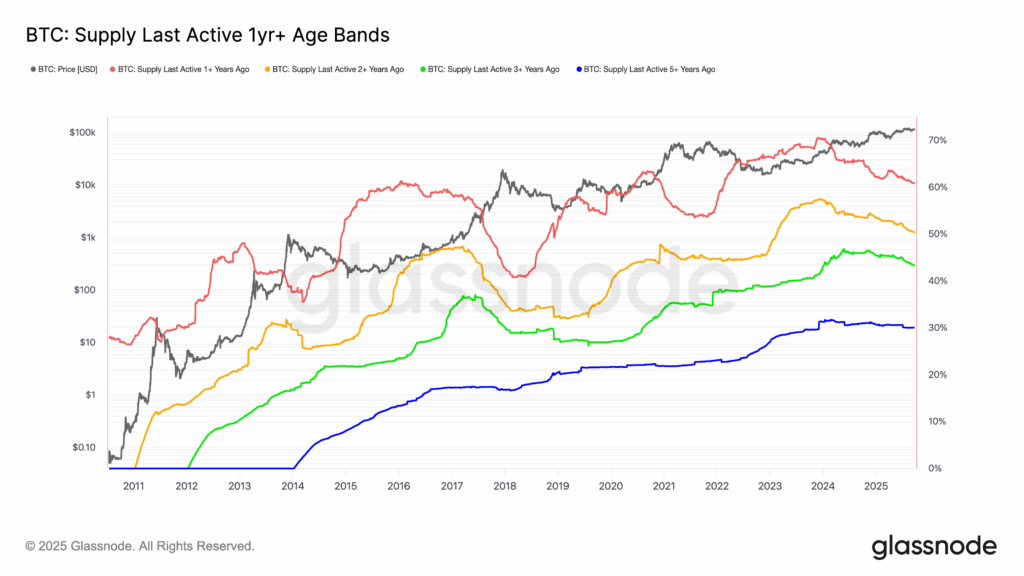

Looking at the long -term holders supply, the percentage of circulating supply without moving for at least 1 year has decreased abruptly from 70% to 60%. The peak was in November 2023, when Bitcoin quoted about $ 40,000. At the same time, the owners of more than 2 years also began to be sold, with their participation in 57% to 52%.

The three -year -old cohort is now just above 43% and has been constantly falling since November 2024. These wallets largely represent buyers of the previous cycle in November 2021 in around $ 69,000, many of which accumulated more during the 2022 bearish market when the prices reach the low of $ 15,500. With the recovery of Bitcoin, these investors are obtaining profits.

On the contrary, five -year -old holders remain stable, which reflects that longer -term investors do not participate in mass sale.

This trend shows that investors who sit on unrealized profits from this cycle continue to obtain profits, which adds to the continuous sales pressure.

Read more: Bitcoin ETF of Blackrock: The bassist feeling in Ibit remains strong for two months in a row