- Nvidia compromises OpenAi $ 100 billion while reinforcing the demand for her hardware

- The association builds massive data centers and feeds concerns about circular investment structures

- Analysts warn of the agreement can raise antitrust scrutiny as Nvidia strengthens the domain of AI

After its recent surprise agreement of $ 5 billion Intel, Nvidia is spending largely, this time compromising up to $ 100 billion for OpenAi along with supplying millions of its chips.

The movement conforms to a broader pattern in which Nvidia channels money in companies that depend on their own hardware, from $ 6.3 billion in Coreweave to $ 700 million in NSCALE, effectively reinforcing the demand for their products while avoiding hyperscalers such as Google and Microsoft that are competing to reduce their dependence on the NVIDIA hardware.

This last investment in the world’s best known company immediately raised the Nvidia market value in more than $ 220 billion.

Circular structure

The agreement implies a circular structure and will see that NVIDIA will buy shares without vote in Openai, which OpenAI will spend mainly on NVIDIA systems.

Citing people familiar with the matter, PakGazette He says that the association will begin with an investment and scale of $ 10 billion as Openai implements more computer energy.

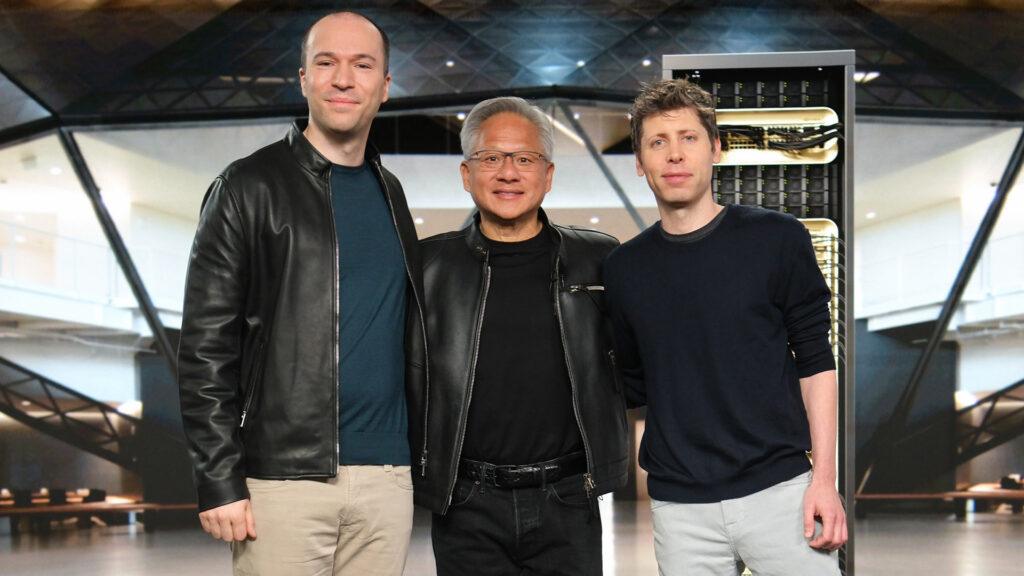

“This is the largest infrastructure project in History,” said the founder and CEO of Nvidia, Jensen Huang, in an interview with CNBC‘S Jon Fortt. “This association is about building an AI infrastructure that allows the world to go to the world.”

He said that companies will build data centers capable of running next -generation AI models, promoted by the new Vera Rubin platform in Nvidia.

The first data centers are due in line in 2026 and require 10 energy gigawatts, approximately equal to the needs of 8 million American homes.

Openai’s executive president Sam Altman said the capacity was essential for the company’s ambitions.

“Building this infrastructure is essential for everything we want to do,” said Altman. “This is the fuel we need to improve, generate better models, generate income, boost everything.”

The analysts welcomed the long -term demand of NVIDIA products, but warned about the structure of the agreement.

“On the one hand, this helps Operai meet some very aspirational objectives for calculation infrastructure,” said Stacy Rasgon in Bernstein. “On the other hand, the ‘circular’ concerns have been raised in the past, and this will feed them even more.”

Kim Forrest, investment director, Bakeh Capital, also rang a precautionary note. “This seems that Nvidia is investing in her biggest client. These arrangements can be beneficial for both parties. But there may also be dangers. Being totally linked to each other can cause myopia and can make an entry point for other chip competitors to enter other AI and cut companies,” he said.

Market intern Rebecca How Allensworth, antimonopoly professor at Vanderbilt Law Faculty, who says there is concern that Nvidia can favor OpenAI with better prices or faster delivery times.

“They are financially interested in the success of the other,” he said. “That creates an incentive so that Nvidia does not sell chips or does not sell chips in the same terms to other competitors of Openai.”

A Nvidia spokesman denied that this was the case, saying: “We will continue to make each client a priority, with or without any capital participation.”

Attend