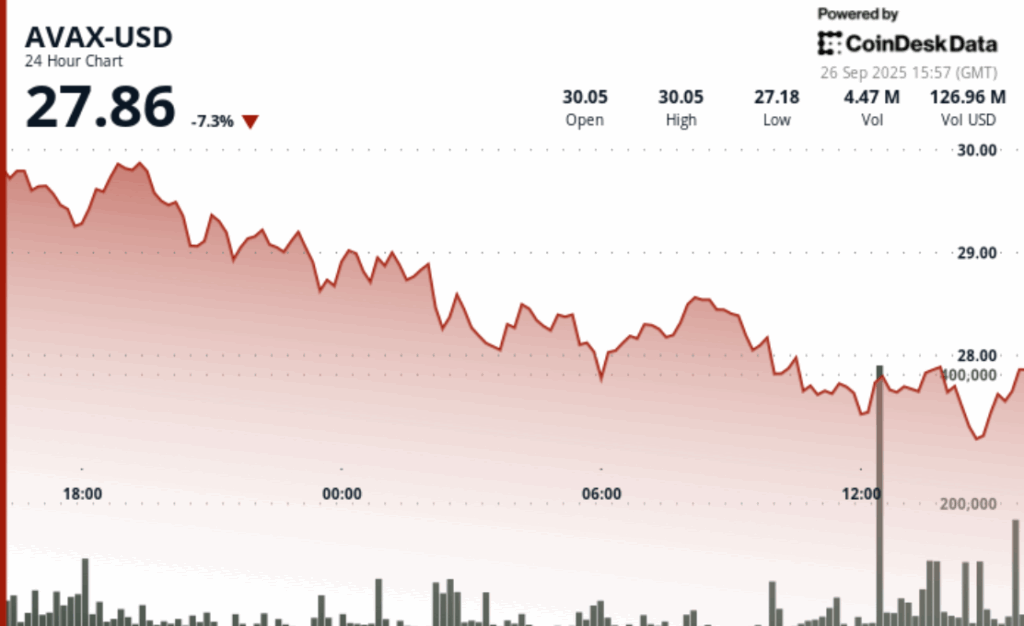

The native token of Avalanche Avax fell 8% in the last 24 hours to $ 27.72, extending a one -week slide that erased almost 18% of its value. The fall occurred along with a wide drop in cryptography markets that have been seen eth, sun, also after the percentage decreases of two digits during the past week and BTC falls 6%.

Avax has struggled to break over a resistance level of $ 30.28 and found only weak support about $ 27.65. Coendensk Analytics data shows that the negotiation volume sank to 121,896 tokens on early negotiation Friday, which indicates that institutional sale can be decreasing but has not yet been reversed.

The price drop occurs following corporate initiatives aligned with avalanche intended to deepen institutional participation. Earlier this week, the Agriforce Growing Systems technology company renamed Avax One and announces plans to raise $ 550 million to acquire and maintain AVAX. The measure would make it the first company that quotes Nasdaq to focus exclusively on the Avalanche ecosystem.

The firm brought together a high -profile advisory team led by the founder of Skybridge Capital, Anthony Scaramucci, and Brett Institutional Coinbase Tejpaul, positioning itself as an important Custodian of Avax. Avax One aims to have more than $ 700 million in the Token, an attempt to consolidate its role as a central figure in Avalanche’s growth history.

But for now, the market has not bought.

The price that falls suggests that institutional sponsors can still be cautious about Avalanche’s long -term positioning. While regulatory approvals for Token -related vehicles are pending, they have not yet translated into the purchase impulse.

The Avalanche road map includes associations and business use cases, but these foundations have not yet counteracted the current sales pressure.