MGX, a background backed by Dubai’s ruling family, will take a 15% participation in the American Tiktok business as part of a restructuring aimed at increasing US control of the popular video application, The Washington Post on Friday reported Friday.

The investment, directed by Sheikh Tahnoon Bin Zayed al Nahyan, puts MGX in an association with Oracle, the database giant co -founded by Larry Ellison. Together, the two will keep approximately 45% of the American Tiktok entity. With other US investors involved, American companies are expected to have more than 65% of the business.

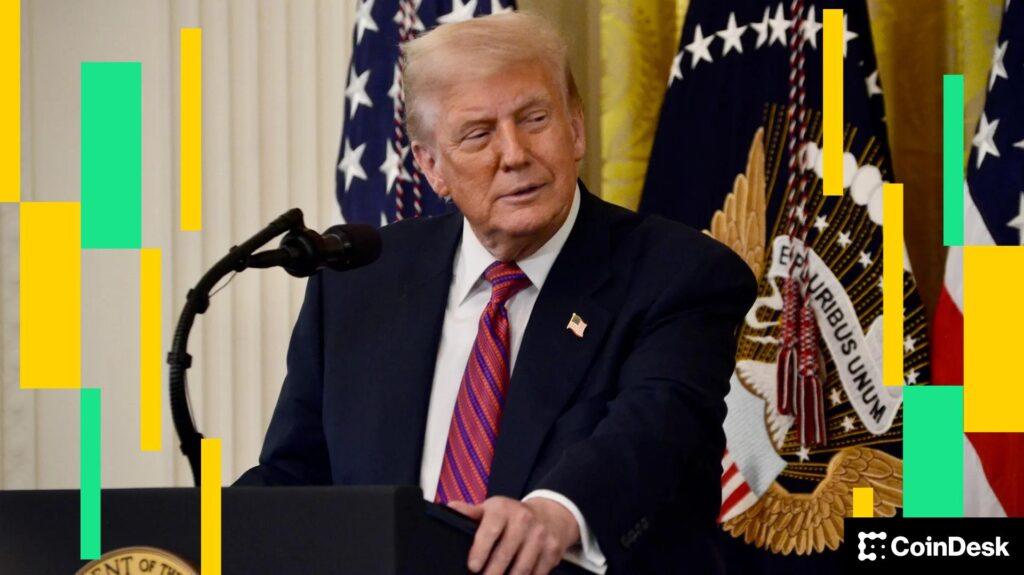

The Chinese father of Tiktok, Bytedance, will continue to be a significant shareholder, maintaining a 19.9% participation in the United States arm, according to The Guardian. This agreement is designed to relieve concerns in Washington, where President Trump has repeatedly pressed for the strictest scrutiny of property and application data practices.

MGX’s role in the agreement adds another layer of intrigue. Earlier this year, the Fund bought USD1 worth $ 2 billion, a stablcoin launched by Donald Trump’s World Liberty Financial. The Token is backed by the treasure of the United States, cash and equivalents, and is presented as a way for people to access financial services without banks. MGX has already implemented USD1 in its investment in Crypto Exchange Binance, which indicates its willingness to use the Stablecoin in large -scale agreements.

For MGX, the Tiktok stake provides a high profile position in the US social media market, where the influence of the culture and advertising platform continues to expand.