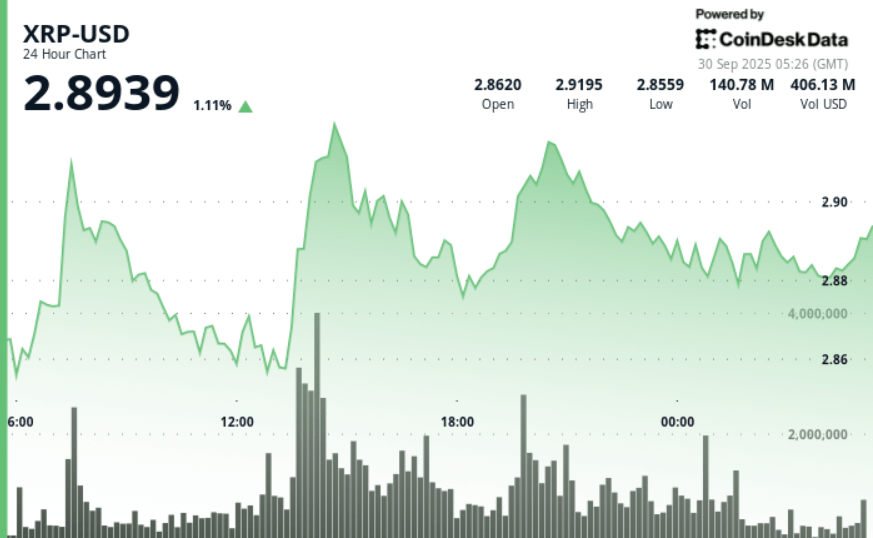

XRP won 2.1% during the 24 -hour negotiation session from September 28 at 9:00 p.m. to September 29 at 20:00, rising from $ 2.84 to $ 2.90 while moving within a $ 0.10 range that represented 3.47% of the opening price.

News history

• Large institutional addresses that have between 10 and 100 million tokens XRP accumulated more than 120 million currencies in the last 72 hours.

• Seven ETF Spot XRP applications remain pending before the US stock and values commission. UU. The presentation of Grayscale is scheduled for October 18, with others in tail until November 14, creating a concentrated window of regulatory catalysts that could remodel short -term flows.

• The feeling of the market has been promoted by the anticipation of the increase in exposure to the corporate portfolio. Analysts frame ETF approvals as a structural driver that could accelerate the adoption of XRP within institutional allocation strategies.

Summary of the price action

• XRP negotiated within a $ 0.10 corridor, fluctuating between a minimum of $ 2.84 and a maximum of $ 2.93, reflecting 3.5% volatility during the period. Price limited about $ 2.93, where the sales pressure intensified, particularly during the 14:00 session of September 29.

• The most significant ascending movements arrived at 02:00 and 07:00 GMT on September 29, where the volume increased to more than 97 million units. These waves significantly exceeded the daily average of 57.4 million, confirming institutional participation during rally phases.

• The last time of negotiation extended the advance, since the price went from $ 2.88 to $ 2.90 for a late 0.7%gain. The violation of the psychological barrier of $ 2.90 was confirmed by an explosion of volume of 4.8 million units, taking the session to its maximum before resolving around $ 2,9045.

Technical analysis

• The resistance is grouped between $ 2.92 and $ 2.93, where the price stops repeatedly in a higher volume. This area marks the next obstacle to the continuation, with a confirmation of rupture that probably requires a closure above $ 2.93 to expand participation.

• The support has consolidated between $ 2.85 and $ 2.86, where buyers constantly defended offers during the retacos. Multiple successful reestimations of this band throughout the session highlight its importance as an accumulation zone.

• The psychological level of $ 2.90 has become a short -term pivot. Price recovered it in the late session, and the merchants will monitor if this can support to go to the weekend.

• Volatility on the 24 -hour window reached 3.47%, consisting of the high institutional reposition around the key regulatory catalysts.

What merchants are seeing

• If XRP can keep closed above $ 2.90 and turn this in support, which will validate the continuation attempts of $ 3.00 and more.

• The October ETF review window of the SEC, with the date of the October 18 gray scale seen as the first important structural catalyst for institutional entries.

• Activity of the whale whale, with 120 million tokens accumulated for three days, which suggests more rise if this rhythm continues.

• Wider macro conditions, with volatility of treasure performance and signs of fed policies that influence risk appetite both in shares and digital assets.