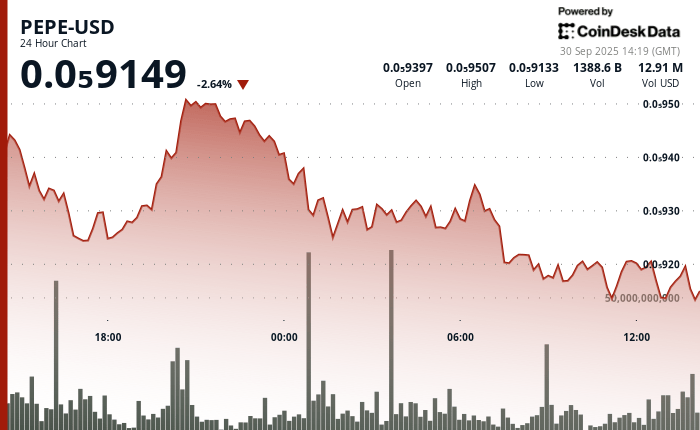

The cryptocurrency inspired by Meme Pepe fell 2.6% in the last 24 hours to operate about $ 0.0000915, significantly under the best performance in the cryptographic market as the Coindesk 20 index (CD20) has dropped 1.4% in the same period.

The Token quoted in a range between $ 0.0000913 and $ 0.0000951, with a brief attempt that a rally stops near the resistance before giving way to a slow decrease, according to the technical analysis data model of COINDESK Research.

The session opened about $ 0.0000939 and reached its maximum point at the beginning of $ 0.000095 before the constant sales pressure weighs in the Token. Pepe’s price constantly decreased during the night and morning hours, briefly consolidating about $ 0.000092 before sliding lower.

Despite the fall, the activity in the derivative markets continued to build and Pepe has managed to overcome the Memeño sector, which as measured by the Coindesk Memecoin index (CDMEME) has dropped 3% in the last 24 hours.

The open interest in Pepe Futures reached $ 560 million according to Coinglase data, while the total negotiation volume increased to $ 1.2 billion.

For now, market observers focus on themselves Pepe can maintain their support point above the support zone of $ 0.000091 or the risks slide towards the lowest ranges.

A break above $ 0.000095 could change the feeling, but any movement of this type should be supported by a stronger volume and a confirmation of broader market conditions.

General description of the technical analysis

Pepe’s 24 -hour negotiation range covered a differential of $ 0.0000034, approximately 4% between the ups and downs of the session and the minimums. Sellers constantly emerged about $ 0.000095, which makes it a clear level of resistance for now.

The support about $ 0.000092 remained during the early and a half session tests, but weakened in the last hours. The Token showed signs of a higher low formation at the beginning of the session, a structure often associated with the bullish accumulation.

However, the decrease in the volume at the closure paints a hesitation image, not conviction. The temporal increase in commercial activity suggest some positioning during short -term breakup attempts, but those efforts lost steam when the volume fell.

Unless buyers return in force, the recent consolidation attempt can give way to a broader setback.