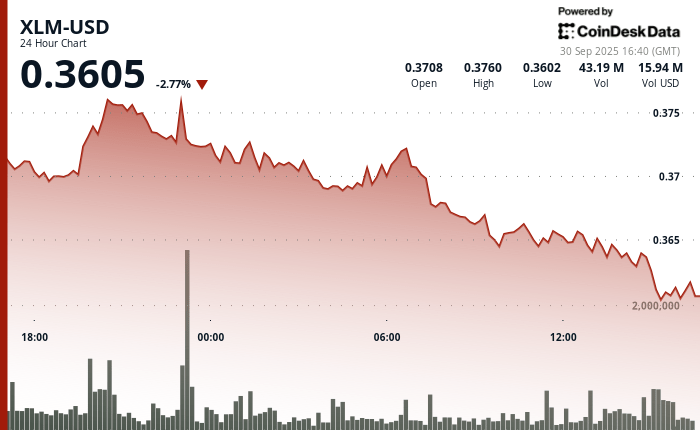

Stellar’s Token XLM faced a bear pressure pronounced at a period of 23 hours between September 29 at 3:00 p.m. and September 30 at 2:00 p.m., falling 4% of $ 0.38 to $ 0.36. The decrease occurred in a narrow range of $ 0.01, underlining the token fight to maintain the impulse. The early resistance to $ 0.38, together with a large negotiation volume of 38.6 million, said a strong institutional sale, while a secondary rejection of the same level, with 18.6 million in volume, reinforced the bassist feeling.

The support arose at $ 0.37 and $ 0.36, and the latter attracted a considerable defensive purchase at the end of the session, since the volumes increased to 31.4 million. While the high volume activity at $ 0.36 suggests accumulation, the broader market structure, defined by lower ups and downs, suggests that the bearish bias remains intact. The violation of the psychological threshold of $ 0.37 further consolidated the case for extended down pressure.

XLM closed the 24 -hour period with a failed recovery attempt of $ 0.37 in its latest negotiation, where volumes increased briefly before being rejected, sealing a accumulated decrease of 4%.

Summary of technical indicators

- Resistance established at $ 0.38 with a high volume of 38.6 million indicating institutional sales pressure.

- The secondary resistance zone around $ 0.38 coincided with a substantial volume activity of 18.6 million.

- Support levels arose at $ 0.37 and $ 0.36 with high volume defense during the final negotiation hours.

- Technical breakdown below $ 0.37 Psychological level confirmed a bearish feeling.

- The critical support breakdown occurred at 13:31 with a high volume of 665,000.

- Zero volume to 14: 07-14: 08 suggests a potential liquidity exhaustion.

- The lower and minimum lower ups and downs pattern indicates a sustained institutional distribution.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.