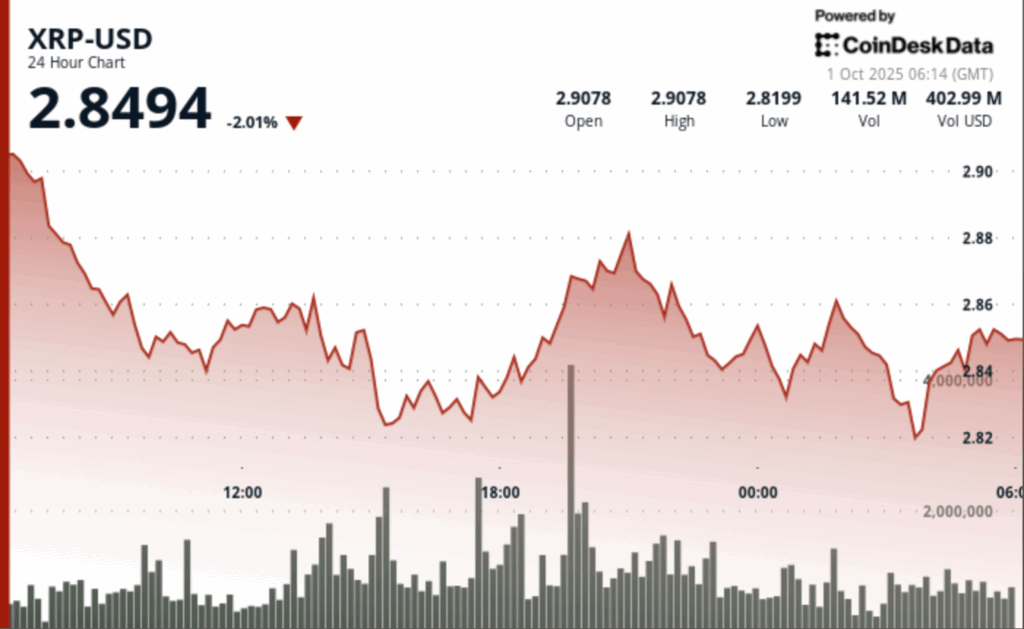

XRP negotiated within a compressed corridor of $ 0.09 after an early impulse at $ 2.91, a strong profits were met. The buyers defended the area of $ 2.82– $ 2.84, leaving the token that is consolidated at $ 2.85 at the closure when the volumes decreased. Analysts marked bearish divergences while reserves increased in Binance, increasing caution before the $ 3.00 test.

News history

- XRP has seen tickets of more than $ 6 billion for two days, driven by the adoption of treasure and speculative positioning.

- The regulatory approach was exacerbated as reports marked zero corporate purchase orders in Binance despite increasing reserves.

- The technical desks of Wall Street advise caution until a rupture above the threshold of $ 3.00 confirms the tendency direction.

Summary of the price action

The aggressive purchase pushed XRP at $ 2.91 at 06:00 in 49.8 million in volume.

The price cut price returns to $ 2.82– $ 2.84, with a turnover well above the 24 -hour average of 56.8 million.

Stabilization in a $ 2.85 band– $ 2.86, with a slimming volume at 4.9 million.

Market capitalization closed about $ 2.85, consolidating profits but not trying again.

Technical analysis

- The resistance hardened at $ 2.91 in a large volume of rejection.

- Validated support at $ 2.82– $ 2.84 with multiple purchase peaks.

- Breakout through $ 2.85 at 01:43 in 1.5 million tokens pointed out the demand driven by something.

- The consolidation of the late session shows a reduced sales pressure but a weak conviction.

- The divergences that are formed in the indicators at the moment limit the upward risk in the short term.

What merchants are seeing

- Can XRP recover $ 2.91 and close above $ 3.00 to turn the resistance?

- Impact of the increase in the 19% binance reserve and if the tickets represent liquidity on the side of the sale.

- Regulatory scrutiny around exchange behavior and lack of corporate offers.

- Fed donation tone in rates like a tail wind for cryptography flows of the triple room.