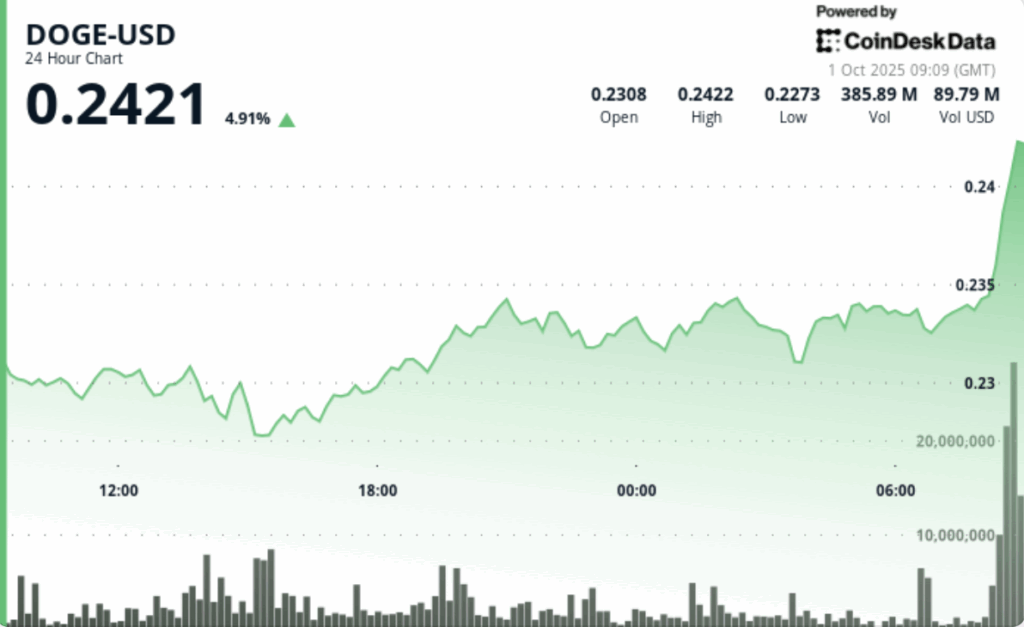

Dogecoin stabilized above the key support as anchored institutional flows liquidity. The buyers repeatedly defended the $ 0.229– $ 0.230 floor, while the rejection volume limited up to $ 0.234.

An impulse of the late session showed a construction impulse, but the conviction remains tied to if Dege can sustain the closures beyond resistance.

News history

Doge advanced 1.6% between September 30, 9:00 am and October 1, 8:00 am, recovering from a minimum of $ 0.227 to close at $ 0.234. Institutional desks dominated the flows, defending the Sub $ 0.230 area during Asian and European hours.

The resistance materialized at $ 0.234, where the volumes exceeded the average of 248.7 million tokens.

Analysts said the session reflected the growing institutional presence in a market once defined by retail participation.

Summary of the price action

The Token was negotiated within a compressed range of $ 0.007, which reflects 3% volatility. The afternoon billing shot over 400 m of tokens, almost two double average levels. In the last hour, Doge increased from $ 0.233 to $ 0.234, with an increase of 15.3m that accompanies an attempt at rupture at 7:32 am

Technical analysis

The support has been validated at $ 0.229– $ 0.230, where multiple defenses remained against the sales pressure. The resistance hardened at $ 0.234, with rejection impressions that limits the demonstrations.

The tight corridor suggests a controlled price discovery dominated by institutional desks, instead of volatility driven by retail trade.

Although the late break shows impulse, a force is required above $ 0.234 to confirm the continuation of $ 0.240.

What operators are seeing?

- If Doge can close decisively above $ 0.234 to turn the resistance.

- If institutional entries maintain volumes above daily averages.

- Wider CD20 index reaction to the relative resilience of DEGE.

- Reestima potential of $ 0.240 should $ 0.229– $ 0.230 the support remains intact during the US hours.