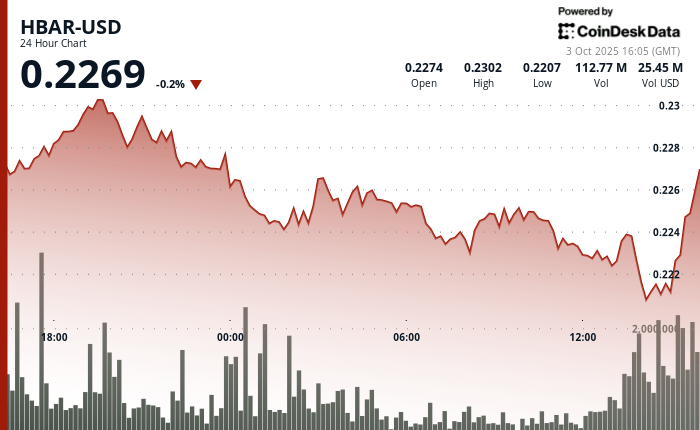

Hbar saw a strong sales pressure on October 3, with an intensifying impulse in the last hour of commerce. After briefly reaching $ 0.224, the Token fell to $ 0.222, violated the key support and finished the session under 0.9%.

The most pronounced fall came between 13:50 and 14:00, when the volumes shot over 3 million, pointing out the institutional distribution and sale driven by panic. Repeated failures to recover $ 0.224 leave Hbar vulnerable to an additional disadvantage towards $ 0.220.

In the largest period of 23 hours from October 2 to 3, Hbar fell 3.6% of $ 0.23 to $ 0.22 in a volume increasing 51.3 million, which underlines a great institutional participation in the sale of the sale.

Despite short -term weakness, attention remains in a possible decision of the SEC in November in the spot cryptographic ETF. With the support of the members of the Governing Council such as Google and IBM, Hedera could benefit from regulatory approval, even when their technicians point to continuous pressure.

Technical metrics indicate continuous weakness

- Hbar formed a different trajectory downwards after its peak at $ 0.23 on October 2, 7:00 p.m., with a resistance in the development of the threshold of $ 0.23 where prices are repeatedly reversed lower during multiple negotiation sessions.

- The essential support was developed at $ 0.23 around midnight on October 3, followed by an additional support area about $ 0.22, although both thresholds demonstrated vulnerability under continuous sale impulse.

- The characteristics of the negotiation volume revealed a high activity during the initial decrease and subsequently during the 13:00 session on October 3 with 51.3 million in volume, indicating the institutional commitment in the bearish movement.

- The technical deterioration intensified during the final time as Hbar fought to maintain recovery efforts above $ 0.22 resistance threshold, validating the violation of essential support thresholds.

- The substantial volume increases to 3 million and 2.5 million during window 13: 50-14: 00 coincided with intense sales activity, demonstrating an institutional distribution and sale driven by fear.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.