Degradation trade, also known as solid money or hard asset trade, is fine and really alive. Bitcoin (BTC), with more than $ 120,000, sits to a stone shot from its historical maximum of $ 124,000. Meanwhile, Gold has almost won 50% in the year to date, establishing new records almost daily and now quoting below $ 3,900.

The flows of funds quoted in the stock market highlight the enthusiasm behind this trade. Both Ishares Trust (Ibit) and the ETF of Gold Spdr (GLD) were among the 10 ETF most negotiated on Thursday, a rare occurrence according to the Senior of ETF of Bloomberg, Eric Balchunas.

The GLD saw a volume of $ 4.88 billion, which makes it the most negotiated fourth ETF, while Ibit arrived in seventh place with $ 3.21 billion. The ETF that is marketed more was the SPDR S&P 500 ETF (SPY) with more than $ 26 billion in volume.

“Everyone wants in the debit trade, I suppose,” said Balchunas.

The comedian and solid money lawyer Dominic Frisby told Coendesk exclusively that both Bitcoin and Gold share a unique property: governments cannot print.

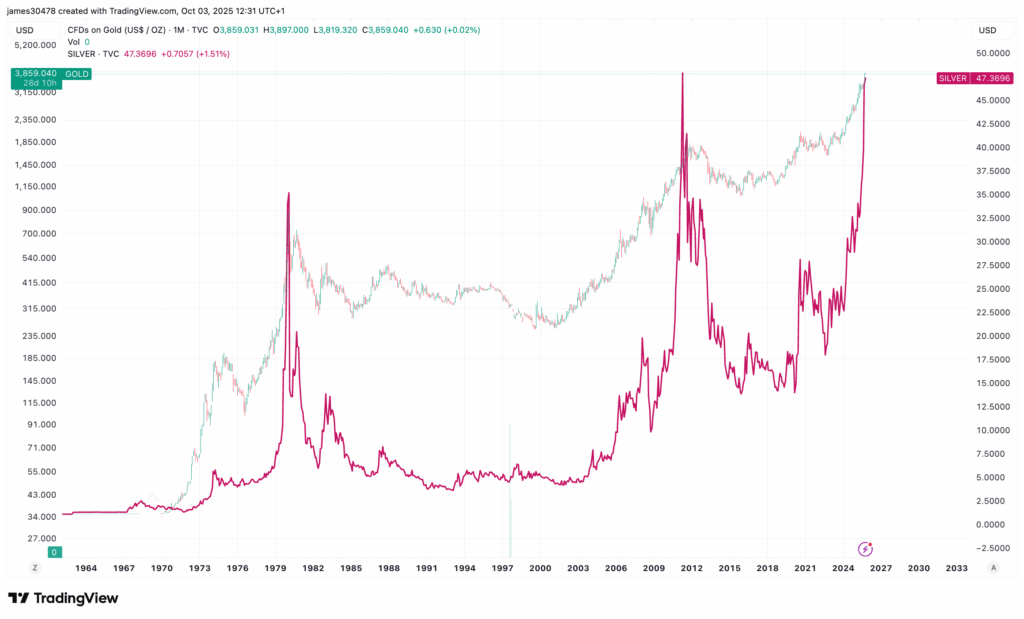

Frisby: “Bitcoin is within a pair of percent of the maximum of all time. Gold in the maximum of all time. Silver approaches the maximum of all time. It is almost as if people are losing faith in Fiat. Nothing lasts forever, of course. But those main money that are immune to the degradation of the government are having their day in the sun. Once again.”

Silver has increased along with gold, currently quoting below $ 48, its third highest level behind Peaks in 2011 and 1980. Interestingly, in both years, Silver’s Top coincided with gold. If the rhyme, this could suggest that when the silver ends its parabolic career, gold can also overcome. That scenario could create the way to a potential even more upwards for Bitcoin.