BNB, the token that feeds the BNB chain and is used for discounts in Binance, recovered more than 4% in the last 24 -hour period, exceeding $ 1,200 and playing an intra -dialy of $ 1,223.

The measure was fed by acute volume peaks, renewed institutional interest and a growing activity of the network. The rally aligned with the BNB chain claiming its place as the block chain most used by active addresses.

In September, he registered 52.5 million active addresses, surpassing Solana for the first time since August, according to Tokentermal data. Behind the activity there was a strong increase in decentralized trade and loans in the Aster protocol, which saw its total value blocked 570% to $ 2.34 billion, for mandating.

Signs of retail impulse also appeared. According to the reports, a high -profile Memecoin merchant made a $ 3,000 commitment to almost $ 2 million after a position of the founder of Binance Changpeng Zhao triggered speculative interests.

The increase comes together with a broader institutional commitment. The manufacturer of electric vehicles Jiuzi Holdings and the German Fund Crypto of Kazakhstan added BNB to their treasure bonds.

It is also worth noting that BNB has benefited, together with the broader cryptographic market, from the expectations that the Federal Reserve will reduce interest rates in 25 BPS at the end of this month, and a recent update where the BNB chain reduced its minimum gas rate to 0.05 GWEI.

General description of the technical analysis

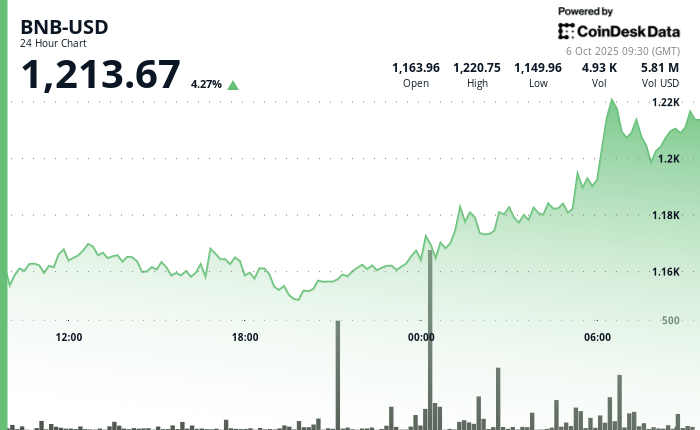

BNB quoted in a wide range during the session, moving between a minimum of $ 1,148.12 and a maximum of $ 1,223.08, according to the technical analysis data model of Coindesk Research.

The price closed to $ 1.201.13, marking a gain of 2.27% on the 24 -hour window. The most notable price action occurred when BNB exceeded $ 1,200 in an increase in negotiation volume, with an activity explosion that reaches almost five times the daily average. This increase in volume coincided with the maximum intradía, which now marks a key resistance zone around $ 1,223.

The support clearly arose in the range of $ 1,148 to $ 1,158, where the purchase pressure appeared constantly throughout the session. Each sauce to this area attracted a new demand, which suggests that institutional orders can be in layers at these levels.

The broader trend remains upwards, with a price action that reflects a constant accumulation and a disposition by buyers to absorb volatility.

However, an acute investment at the end of the session indicated caution. After testing the $ 1,215 area, BNB fell quickly to $ 1,201, reducing the previous profits.

The high volume during this setback suggests a profits instead of the sale of panic, probably of the largest holders that capitalize on the resistance near the recent maximums. Despite the setback, BNB maintained most of his profits and remained above the $ 1,200 brand, keeping the current rally intact.

Discharge of responsibility: Parts of this article were generated with the assistance of AI tools and reviewed by our editorial team to guarantee the precision and compliance with our standards. For more information, see Coindesk’s complete policy.