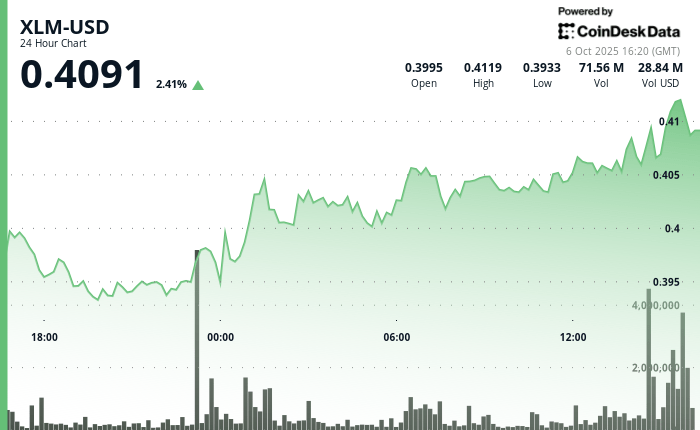

Stellar Lumens (XLM) rose 3% in a 23 -hour stretch that ended on October 6, increasing from $ 0.40 to $ 0.41 as institutional trade increased above 71 million tokens.

The measure followed a technical rebound of $ 0.39, with the merchants who conduct the demand during the maximum negotiation hours and supported a stable rally through key resistance levels.

XLM’s capacity to stay above the $ 0.41 brand, a level that previously limited price profits, reflects continuous institutional accumulation and confidence in the long -term role of Token within the financial infrastructure based on blockchain.

Analysts see the constant purchase pressure of corporate accounts as evidence of a growing recognition of Stellar’s business utility.

Market strategists see a more upward potential, identifying XLM as one of the most undervalued payment tokens that are quoted below $ 1.00.

They predict that the Token could address the level of $ 1.00 in the next institutional adoption cycle as Blockchain payment networks gain traction in the global corporate finance panorama.

Technical metrics indicate institutional accumulation

- A strong institutional support established at $ 0.39 with corporate volume confirmation of 62.57 million tokens during the October 5 negotiation session.

- Technical resistance to levels of $ 0.41 showed multiple phases of institutional tests before a successful break in corporate purchase.

- The trend of ascending prices of the base of $ 0.39 provided constant institutional support throughout the accumulation phase.

- The corporate commercial activity remained high during the key movements of prices, particularly at 13:38 with 2.86 million tokens confirming the institutional progress above $ 0.41.

- The highest pricing levels demonstrated a sustained corporate accumulation during the final negotiation time.

- Daily negotiation volumes exceeded 71 million tokens during institutional negotiation hours, significantly above the 24 -hour corporate average of 25.43 million.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.