Bitmine Immersion Technologies (BMNR), the firm of the digital treasure centered on Ethereum directed by Thomas Lee de Fundstrat, continued buying ether Add 179,251 tokens to your balance until last week, with a value of approximately $ 820 million to current prices.

With the last purchase, the Stash ETH eth of the firm exceeded 2.83 million tokens, more than 2% of the second largest cryptocurrency supply, according to a press release from Monday.

The shares have increased 4% prior to commercialization together with weekend earnings in cryptography prices.

The company said that total crypto and effective reserves are $ 13.4 billion, including $ 456 million in cash, 192 Bitcoin and a participation in Ochoco Holdings (ORBS), a Treasury Treasury vehicle centered on digital assets .

BMNR shares increased 4.3% prior to the market just over $ 59, its strongest level in two weeks.

From the firm’s June pivot, Bitmine is part of the trend of digital assets, where companies listed in public raise funds to accumulate cryptocurrencies, following the play book of Michael Saylor’s strategy, the world’s largest corporate owner.

Bitmine aims to corner 5% of Ether’s supply and generate performance when reaching tokens. The company is currently located as the largest Treasury Eth firm and only follows BTC’s holdings of the Bitcoin -centered strategy among all cryptographic treasury companies.

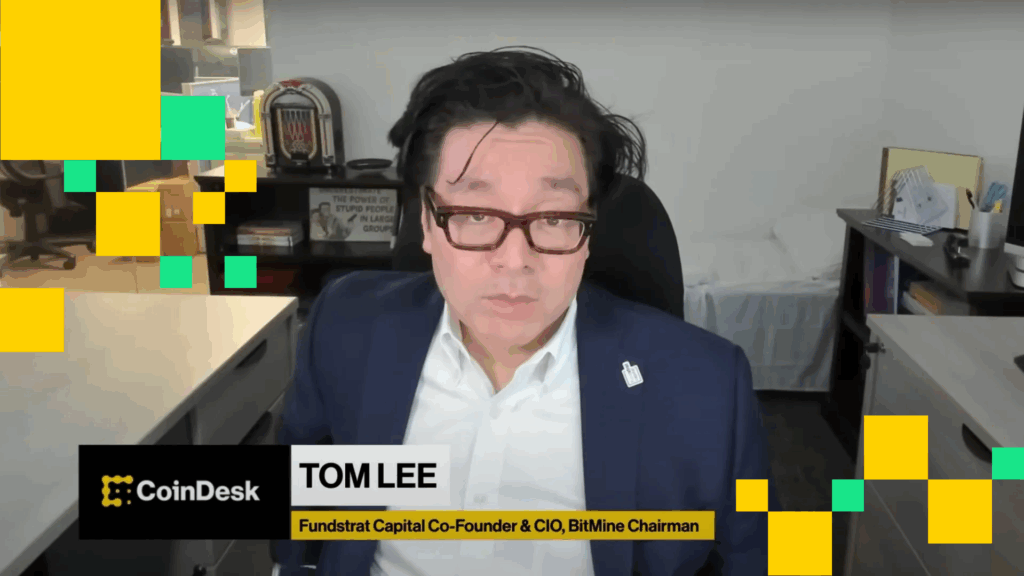

“We are still sure that the two supercycle investment narratives remain [artificial intelligence] AI and Crypto, “President Thomas Lee said in a statement.” Since the price of ETH is a discount for the future, this is a good omen for Token and is the reason why the main asset of Bitmine’s treasure is Eth. “

Read more: how Ethereum’s Fusaka update could be a game change, explains assets manager Vaneck